Crypto Should Be Decentralized - So Why Do We Need Centralized Exchanges?

if you have never traded or held cryptocurrency, CEXs make it easy, as all you need to do is create an account with an email address and KYC documentation without needing to store your own seed phrase or private keys.

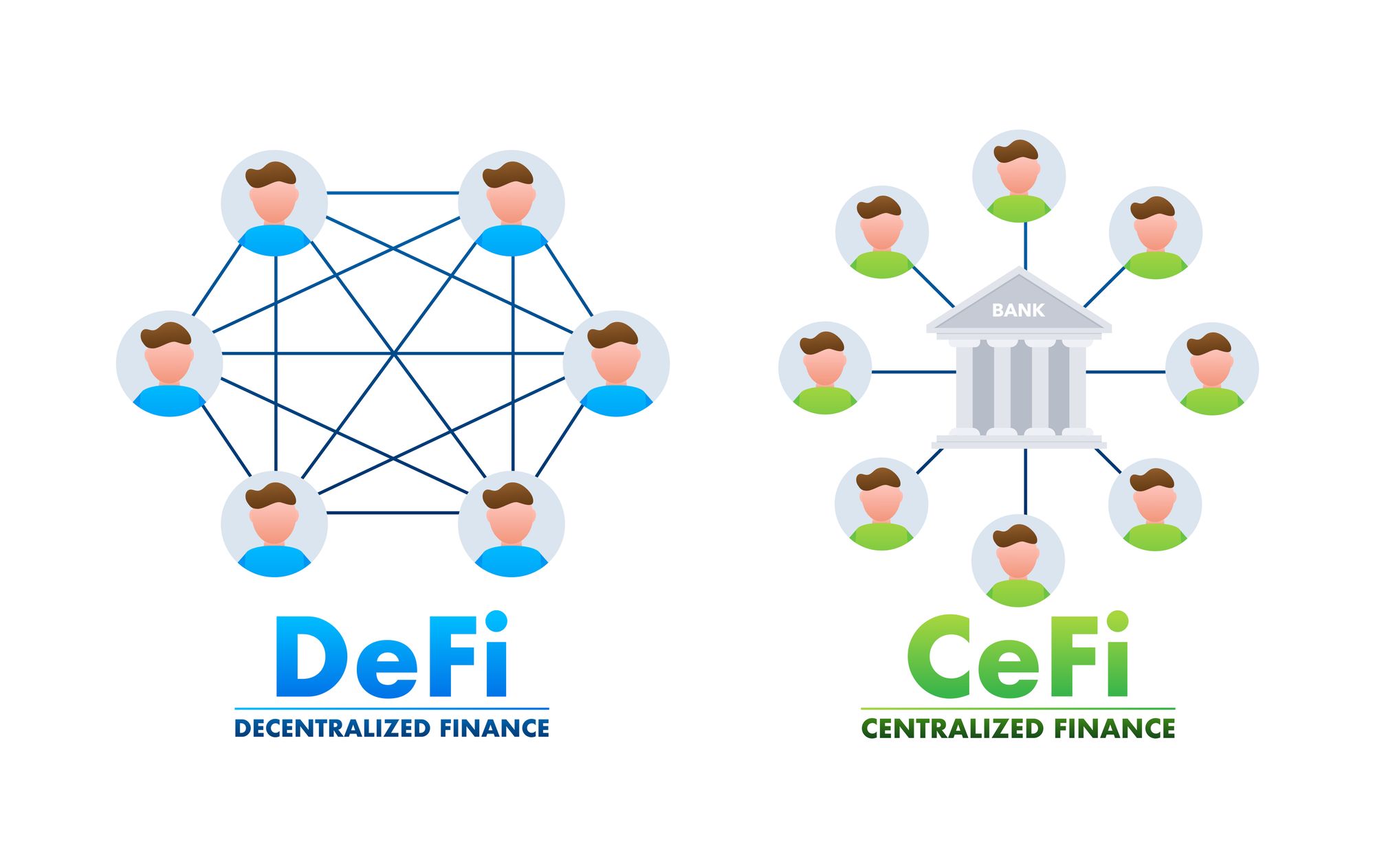

The prominence of Centralized Exchanges (CEXs) in the world of cryptocurrency is quite puzzling to industry enthusiasts, pessimists, and even neutrals. For a technology that preaches Decentralization, a huge part of the entire market's equity is present in CEXs. According to a report from ConsenSys, 99% of all crypto transactions go through CEXs, a transaction volume that amounted to over $14 trillion in 2021.

So, if decentralization is synchronous with cryptocurrency and blockchain technology, why do CEXs wield so much influence?

How Centralized Exchanges (CEXs) Work

CEXs are traditional companies registered under a specific jurisdiction and compliant with local regulations. Hence, every CEX has a CEO, with whom lies the decision-making responsibility of the company. Hence, for every CEX you use to trade or keep your crypto assets, you are ENTRUSTING your money into the hands of certain individuals, which is contrary to the purpose of cryptocurrency.

We can liken CEXs to banks where you deposit money in an account and make transactions from there, all while your funds are within the bank's custody. If the bank becomes insolvent, you may lose your money unless a bailout occurs.

The recent revelations behind the insolvency and bankruptcy of FTX have seen a lot of questions being asked about the safety and security of funds in a CEX, and some people have questioned the motive of Centralized Exchanges and if they are safe to use.

Why CEXs Are Indispensable

Ease of Use: Compared with Decentralized Exchanges, CEXs are pretty easy to navigate, with user-friendly interfaces and customer support structures. In fact, if you have never traded or held cryptocurrency, CEXs make it easy, as all you need to do is create an account with an email address and KYC documentation without needing to store your own seed phrase or private keys.

Beginner Friendliness: To trade on DEXs, you need to be familiar with technicalities such as linking wallet to exchange, approving token spend via smart contracts, avoiding transaction slippage, etc. However, trading on CEXs is pretty straightforward, and with little help, many beginners can navigate it after a few tries.

Ease of Converting To and From Fiat: Since many CEXs are regulatory-compliant, they are legalized by many countries as financial institutions (unlike DEXs). Hence, many can easily sell and buy cryptocurrency from their bank accounts.

High Liquidity: It's no surprise that Centralized exchanges provide higher liquidity due to the ease of converting to/from fiat and its beginner-friendliness. Hence, the volume on CEXs makes it easy for you to instantly trade your cryptocurrency at a price similar to what you requested, avoiding price changes due to volatility.

Insurance Policies: Unlike DEXs, some CEXs offer insurance against losses. For example, when Bitfinex was hacked in 2016, many people got refunded due to the insurance policy.

Evidently, the ease offered by CEXs makes them a popular choice among users; the custodial nature makes it easy for beginners as they don't have to worry much about security beyond 2-factor authentication. However, in cases of blanket failures like FTX's, everyone with assets in the exchange suffers losses.

Do CEXs Pose A Risk To The Fidelity Of Crypto And Blockchain Technology?

The short answer to this question is no. However, a comprehensive answer may not be definitive.

The impossibility of directly funding crypto wallets from bank accounts makes it difficult to use decentralized exchanges in isolation; even for people who complete most of their crypto transactions via DEXs, CEXs are important. For example, if I intend to complete ETH transactions via Uniswap, I need to get some ETH tokens into my non-custodial wallet, where I can access the Uniswap DApp.

However, getting the ETH tokens with my USD bank balance without using a CEX can be unnecessarily cumbersome, as I have to look for a P2P trading platform for someone to take my USD and give me ETH. However, with CEXs large crypto volume, I can easily get ETH in a few seconds.

CEXs fill a gap in the industry, allowing ease, even where DEXs cannot effectively function. However, in the bid to solve a few problems, they have exacerbated other problems, such as the risk of hacks, funds mismanagement, censorship, etc.

Not Your keys, Not Your Crypto!

CEXs are a necessary evil in the crypto world; however, users must approach them cautiously when electing to use them. Hence, it is important to ONLY use Centralized Exchanges as a means to trade and swap tokens. However, when participating in deeper crypto functionalities like staking, NFT purchases, or even holding tokens for the long term, you should consider using non-custodial wallets.

As mentioned earlier, CEXs are embedded with custodial wallets, like bank accounts where you keep your funds and can access them. However, you don't have sole control over this wallet because you don't hold private keys. Hence, to mitigate the risks associated with using CEXs, it is important for users to AVOID carrying out any transaction that involves the long-term holding of assets on CEXs.

Key Takeaway

CEXs are essential for the everyday crypto user, as they allow ease on many fronts; they are compatible with several blockchain networks, list many tokens, etc. However, it is important to note that no one can ensure the security and safety of your funds better than yourself; hence, to avoid being a victim of the several failures of CEXs, you should NEVER hold or stake tokens there in the long term.

Check out the Cwallet App today! A multi-dimensional crypto wallet that allows you to own a Custodial AND Non-custodial wallet within a single app. So, as a beginner, you can easily familiarize yourself with cryptocurrency without worrying about your security; whenever you feel capable, you can switch to the non-custodial wallet and OWN YOUR SECURITY.

What's More?

Cwallet Does Not Charge Any Deposits, Withdrawals, And Token Swap Fees. Therefore, Using Cwallet Is Absolutely FREE!

So, Why Wait? Download The Cwallet NOW!