Cryptocurrency loans are now a useful financial instrument within the crypto space, allowing stakeholders to access liquidity without needing to sell their digital assets. Within the essence of crypto loans are interest rates and the different types of loans that exist. An understanding of the nuances between loan options is necessary for anyone considering entering the crypto lending market.

Crypto loans can be fixed or flexible; each option offers distinct approaches to crypto lending, with varying sets of features, benefits, and risks. The right type for you depends on the specific features of the loan as well as other determining factors.

All you need to know about the types of crypto loans and how they affect your borrowing experience is included in this article.

What are Fixed Crypto Loans?

Fixed crypto loans are loans in which the interest rate remains constant throughout the loan term. This means that borrowers know exactly how much interest they will pay over the duration of the loan. Fixed interest loans provide predictability and stability in their repayment schedule.

Fixed interest rate: The interest rate is set at the time of loan origination and remains unchanged for the entire loan term. Borrowers repay the loan amount, along with accrued interest, according to a predetermined schedule. Fixed crypto loans may have varying durations, ranging from short-term loans to longer-term financing options.

How Fixed Rates Work in Crypto Lending

With fixed crypto loans, the interest rate is decided by the lender when you first take out the loan. Once it's set, it stays the same no matter what happens in the cryptocurrency market or with your finances.

Lenders usually offer rates that are competitive, meaning they're similar to what other lenders are offering. This helps attract borrowers. And since the interest rate doesn't change, borrowers always know exactly how much they'll have to pay back.

What are Flexible-Rate Crypto Loans?

Flexible crypto loans, also known as variable-rate loans, are loans where the interest rate can change over time.

Unlike fixed-rate loans, where the interest rate stays the same, with flexible-rate loans, the interest rates can increase or decrease depending on certain factors.

As a result, borrowers may pay different amounts of interest from month to month.

Factors Affecting Flexible-Rate Loans

- Supply and Demand: An increase in the demand for crypto loans may increase the interest rate, while a decrease in the demand for crypto loans will definitely decrease the interest rate. Conversely, an increase in the total value of crypto assets ready to be disbursed as loans will also reduce interest rates, and vice versa.

- Lender Policies: Lenders may have their own policies regarding how often and by how much they adjust interest rates on flexible rate loans. These policies can vary from lender to lender and may affect the borrower's overall cost of borrowing.

- Market Speculation: Lenders sometimes anticipate future changes in market conditions, and use these expectations to set the interest rate, which may increase or decrease based on their findings and expectations.

- Creditworthiness: Lenders may assess the creditworthiness of borrowers to determine the level of rate change for a loan. For instance, where lenders might have initially charged a higher interest rate to a high-risk borrower with a poor credit history, they might reduce the interest rate when his credit history becomes better, and vice versa.

- Volatility: Cryptocurrencies are quite volatile. Hence, depending on the extent of the volatility of your collateral, your interest rate might change too. If your collateral is a cryptocurrency that radically drops in price frequently, your interest rate would be higher too.

Fixed-Rate Loans vs Flexible-Rate Loans

FIXED LOANS | FLEXIBLE LOANS | ||

1 | Interest Rate Stability | Borrowers can accurately forecast their repayment obligations since the interest rate remains constant. | The fluctuating interest rates can make budgeting and planning for loan payments challenging since they may change over time. |

2 | Certainty | Fixed loan rates simplify financial planning by eliminating uncertainty about future interest payments. | There is a risk of uncertainty. If interest rates decrease, borrowers could pay less over time, potentially saving money on their loans. Also, if interest rates increase, borrowers could pay more in interest, leading to higher monthly payments. |

3 | Cost Structure | Fixed-rate loans may initially have higher interest rates compared to flexible loans, resulting in higher borrowing costs in the short term. | Flexible loans may start with lower interest rates compared to fixed-rate loans, which could result in lower initial borrowing costs. |

4 | Market Conditions | Fixed-rate loans do not adjust to changes in market conditions, limiting borrowers' ability to take advantage of favorable interest rate environments. | Flexible loans are influenced by market conditions, making them more susceptible to changes in the cryptocurrency market or economic factors. |

5 | Stability | Fixed-rate loans are ideal for borrowers seeking predictability and stability in their loan payments, particularly in a rising interest-rate environment. | Flexible-rate loans are suited for borrowers comfortable with potential fluctuations in interest rates and seeking the possibility of lower initial rates or cost savings if rates decrease. |

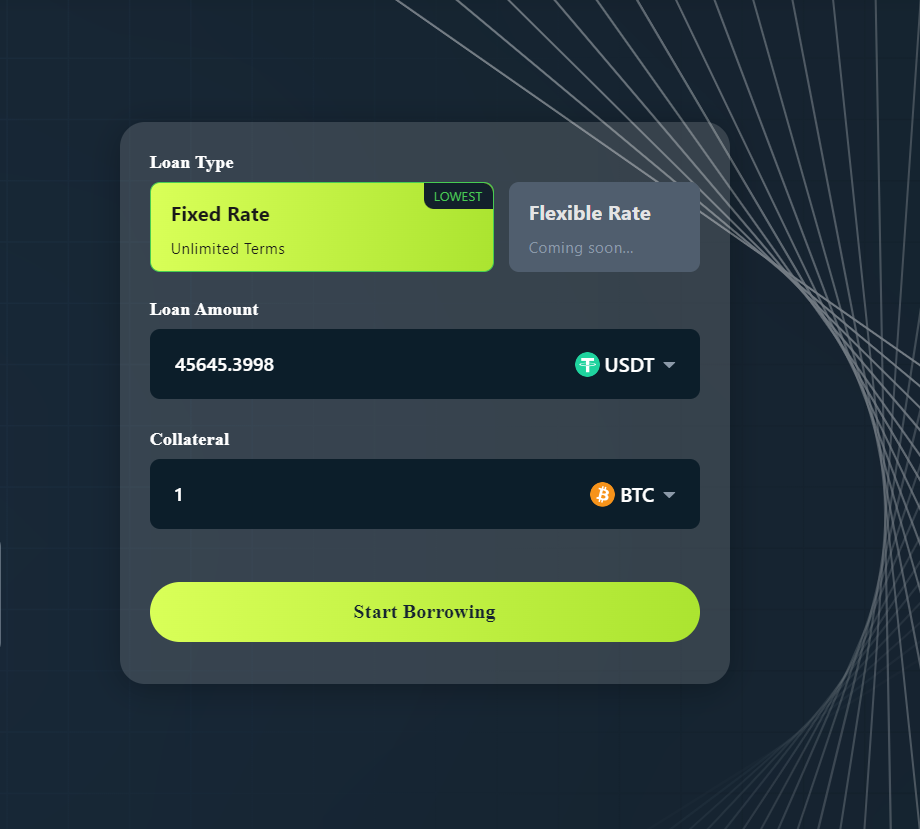

Fixed Rate and Flexible-Rate Loans on Cwallet

Cwallet is a multifunctional crypto wallet, offering a crypto lending feature that allows users to secure loans against their crypto assets at very low interest rates.

This service combines the functionalities of a wallet with those of a comprehensive exchange platform, making it easy to own and manage crypto assets. Cwallet's crypto lending feature is designed to be cost-effective and user-friendly, accommodating diverse borrowing needs for both short and extended periods. Cwallet's approach prioritizes simplicity and accessibility, catering to users of all expertise levels.

Cwallet supports lending in multiple cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), and Tether (USDT), allowing you to use 10+ common cryptocurrencies as your collateral, while enjoying a whopping 65% LTV ratio.

Currently, Cwallet charges a fixed Annual Percentage Rate (APR) of 13%; however, in coming months, Cwallet is set too add flexible-rate options to its platforms to offer the most competitive interest rates for borrowing in the market.

End Note

Understanding the differences between fixed-rate loans and flexible-rate loans is essential for borrowers to choose the loan type that best aligns with their financial goals, risk tolerance, and market outlook.

There’s no one-size-fits-all approach to choosing what works best for you as a borrower. All you have to understand is what these loans entail and their subsequent risk. Place your knowledge of each of these loans, your risk tolerance, and financial goal on a scale, use this to determine your choice.

Safe crypto investing requires smart decisions with the right tools and partners. Cwallet is positioned to help you with safe crypto lending with its fixed-rate loans and the soon-to-be-launched flexible-rate loans. So, don’t wait; get started with Cwallet now!

Leave a Comment