Why KYC is Essential for Secure Crypto Transactions: A Look at Cwallet's KYC Process

Fraud is a significant concern in the cryptocurrency space due to the pseudonymous nature of transactions and the irreversible nature of blockchain technology. KYC processes are essential in identifying and preventing fraudulent activities by ensuring that users are who they claim to be.

As the use of cryptocurrencies grows, so does the need for robust security measures. One such critical measure is the Know Your Customer (KYC) process. KYC refers to the procedures that financial institutions and service providers use to verify the identity of their clients. This process typically involves collecting personal information such as name, address, and identification documents to ensure that the user is who they claim to be.

The relevance of KYC in financial transactions cannot be overstated. It is a fundamental practice in traditional banking and financial services, designed to prevent fraud, money laundering, and other illicit activities. The anonymous nature of blockchain transactions can be exploited for illegal purposes, such as financing terrorism, evading taxes, or conducting fraud. Implementing KYC protocols helps mitigate these risks by ensuring that only legitimate users can access and use cryptocurrency services.

This article tells you why KYC is important in crypto asset management.

What is KYC (Know Your Customer)?

KYC, or Know Your Customer, is a critical process employed by financial institutions and service providers to verify the identity of their clients. The primary goal of KYC is to ensure that the individuals or entities engaging in financial transactions are accurately identified and verified. This process involves collecting and analyzing various personal information and documentation, such as government-issued identification, proof of address, and, in some cases, financial statements.

The concept of KYC has its roots in the regulatory frameworks established to combat financial crimes. In the early 2000s, the global financial industry faced increasing pressure to implement robust measures to prevent money laundering, terrorist financing, and other illicit activities. This led to the development and enforcement of stringent KYC regulations by various international bodies and national governments.

One of the most significant milestones in the evolution of KYC was the implementation of the USA PATRIOT Act in 2001, following the September 11 terrorist attacks. This act introduced comprehensive anti-money laundering (AML) measures, including mandatory KYC procedures for financial institutions operating in the United States. Similar regulations were adopted worldwide.

Why is KYC Important in Crypto Transactions?

- Fraud Prevention: Fraud is a significant concern in the cryptocurrency space due to the pseudonymous nature of transactions and the irreversible nature of blockchain technology. KYC processes are essential in identifying and preventing fraudulent activities by ensuring that users are who they claim to be.

Verifying the identity of users reduces the risk of accounts being opened under false pretenses or with stolen identities. Regular KYC checks can help detect and prevent unauthorized access to user accounts. - Anti-Money Laundering (AML) Compliance: Anti-Money Laundering (AML) laws are designed to prevent the illicit movement of money, including money laundering, terrorist financing, and other financial crimes. KYC is a cornerstone of effective AML measures. KYC ensures that users are accurately identified and helps to track and monitor their transaction history for suspicious activities. Continuous monitoring of transactions allows for the detection of patterns that may indicate money laundering activities. KYC enables crypto service providers to meet their regulatory obligations by providing necessary information to financial authorities and law enforcement agencies.

- Enhanced Security: KYC processes provide an additional layer of security that protects user funds and personal information. KYC enhances security by preventing unauthorized access. KYC ensures that only authorized users can access their accounts. Securely storing and managing personal information collected during KYC helps prevent data breaches and identity theft. With verified identities, it becomes more difficult for malicious actors to execute fraudulent transactions or manipulate the system.

- Building Trust: Trust is a critical factor in the adoption and success of cryptocurrencies. Verifying user identities increases transparency, making it easier to trace transactions and hold users accountable. When users know that a platform employs rigorous KYC procedures, they feel more secure and confident in using the service. Demonstrating compliance with KYC and AML regulations helps crypto businesses establish credibility and positive relationships with regulators.

- Legal Compliance: As cryptocurrencies gain mainstream acceptance, regulatory bodies around the world are implementing stringent requirements to ensure the industry operates within legal frameworks. Adhering to KYC regulations is mandatory for operating legally in many jurisdictions, preventing legal repercussions and fines. KYC practices help crypto businesses align with international standards With KYC, crypto businesses can more easily navigate the complexities of international regulations, enabling seamless cross-border transactions.

A Guide to Cwallet’s KYC Process

Starting your crypto trading journey on Cwallet begins with creating an account. Start by downloading and installing the app, then proceed to register, verify your email, and set up 2-factor Authentication (2FA). With your account now established, the next critical step is completing the Know Your Customer (KYC) verification.

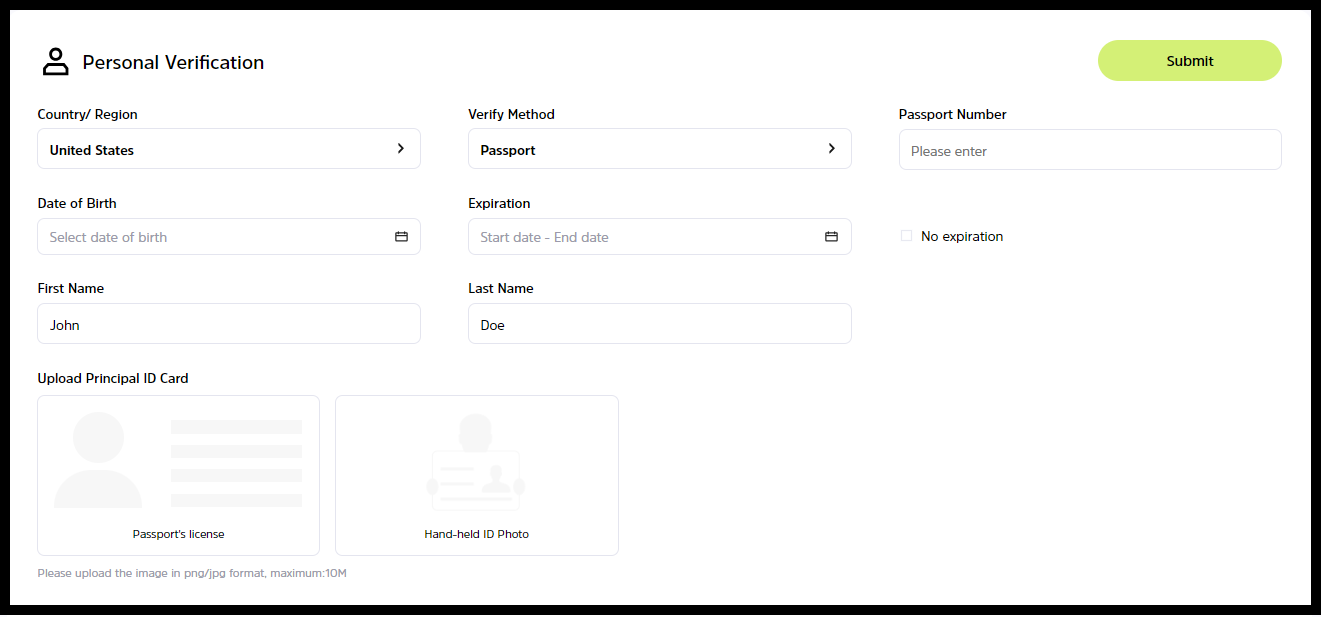

Upon logging in, navigate to the KYC section found within your account settings. Here, you will be prompted to provide essential personal details, including your full name, date of birth, and residential address. It is imperative that this information matches your official identification documents to avoid any discrepancies during the verification process.

The subsequent step involves uploading clear, high-resolution images of your government-issued ID, such as a passport or driver’s license. Both the front and back of the ID must be submitted to ensure all pertinent information is visible. This document submission phase is crucial, as it serves as the primary evidence needed to confirm your identity. Cwallet specifically requires a government-issued photo ID, with passports being the preferred document. Ensure that all documents are in good condition, legible, and unexpired, as poor-quality images or altered documents will lead to rejection.

Once your documents are submitted, Cwallet’s verification team meticulously reviews them to verify their authenticity and accuracy. Following this review, you will receive a notification regarding your verification status via email and in-app notifications. Upon approval of your documents, your account will be fully verified, unlocking access to the full suite of Cwallet features. These features include the Cwallet Buy/Sell Feature, crypto loan facilities, and the P2P trading feature, among others.

Completing the KYC process not only secures your account but also enables you to fully leverage the robust functionalities that Cwallet offers.

See Also: How Cwallet Guides Users Through the Crypto KYC Lifecycle

End Note

In summary, the importance of KYC in crypto transactions cannot be overstated. It plays a vital role in fraud prevention, AML compliance, enhanced security, building trust, and legal compliance. As the crypto industry continues to grow, robust KYC measures are crucial in maintaining a secure and transparent environment. Cwallet ensures that its users are thoroughly verified, significantly reducing the risks of fraud and unauthorized access.

For users, completing the KYC process with Cwallet is a vital step towards a safer and more secure crypto experience.

Download Cwallet and get started with secure crypto trading today!