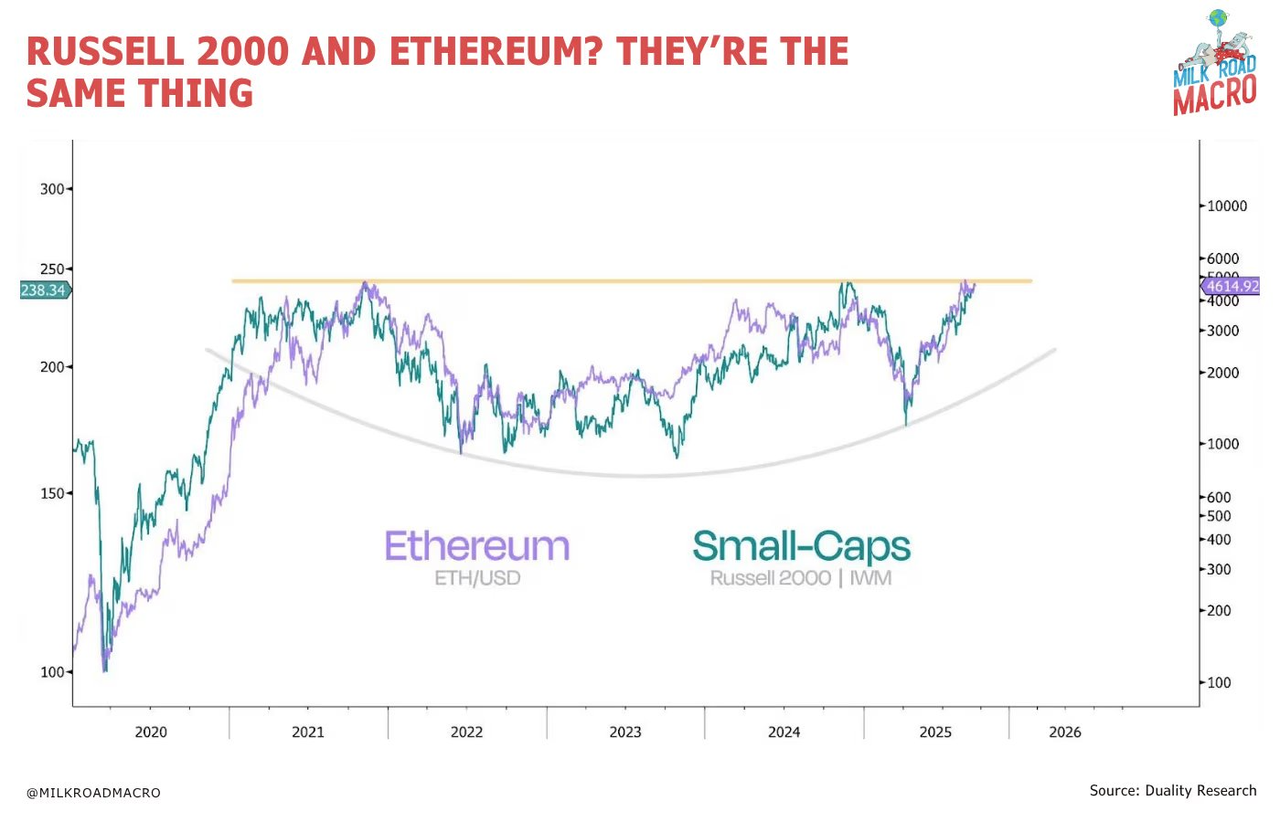

Why ETH's Next Breakout Is Now Tied to the Fate of Small-Cap Stocks? What's Behind the "Spooky" Correlation?

The synchronous movement between Ethereum (ETH) and the Russell 2000 confirms ETH has matured into a macro-correlated, rate-sensitive asset.

Key Takeaways

- The synchronous movement between Ethereum (ETH) and the Russell 2000 confirms ETH has matured into a macro-correlated, rate-sensitive asset.

- Impending Fed rate cuts are the primary catalyst, signaling the start of a structural capital rotation out of fixed income and into high-beta growth assets.

- ETH is the lead beneficiary because its staking yield positions it as a structurally superior, productive asset when traditional bond returns are falling.

- Both ETH and the small-cap index are displaying a "Cup-and-Handle" pattern, providing a strong technical signal of an imminent, synchronized bullish breakout.

The crypto market is no stranger to paradox, but a recent observation has stunned analysts: the price action of Ethereum (ETH) is moving in near-perfect lockstep with the Russell 2000 Index, the benchmark for U.S. small-cap stocks. This unexpected synchronicity, a correlation analysts call "spooky", signals that ETH has fundamentally matured into a macro-correlated, rate-sensitive asset.

This is not a coincidence. This strong structural link suggests that the impending Federal Reserve rate cuts will act as the direct catalyst for both assets. This article dissects the macro forces at play, revealing why the fate of Ethereum's next breakout is now structurally tied to the performance of traditional high-growth equities.

Macro Thesis: Capital Rotates on Rates

The strong correlation between Ethereum and small-cap stocks is based on a foundational principle: when central banks shift from tightening to monetary easing, capital flows out of static assets and into high-beta growth opportunities. This move is a strategic repositioning known as capital rotation.

The Engine of Outperformance

The impending Fed rate cuts, which have already begun after a lengthy tightening cycle, are the direct catalyst for this rotation.

- Small-Caps Outperform: Historically, when the Fed cuts rates, small-cap stocks (Russell 2000) tend to outperform large-cap stocks. This is because small companies rely heavily on external financing, and falling borrowing costs immediately serve as a tailwind for their growth prospects and valuations.

- The Risk-On Switch: Lower interest rates make traditional "safe" investments, such as Treasury bonds and savings accounts, less attractive. This loosens financial conditions and forces conservative capital off the sidelines, pushing it into assets positioned for aggressive growth.

Ethereum's Competitive Edge: The Yield Factor

In this new environment, Ethereum becomes a preferential destination for rotating capital because it is a productive asset, offering a critical advantage over traditional high-beta investments.

- Beating Fixed Income: In a low-rate environment, the staking yield generated by Ethereum (which often sits around 3-4%) becomes highly competitive compared to the falling yields of U.S. Treasury bonds and money market funds.

- The Productive Asset Mandate: ETH's ability to generate yield through its staking mechanism means it is fundamentally superior to a non-yielding commodity like Gold, which traditionally benefits from monetary easing. Investors are seeking assets that not only hedge against devaluation but also produce sustainable returns.

This structural alignment confirms that Ethereum is no longer just a digital curiosity; it is a macro-correlated assetwhose performance is directly linked to the global cost of money.

Technical Setup and the Small-Cap Precedent

The powerful macro narrative being built by the Fed is finding strong confirmation in the technical charts, suggesting that a market move is imminent.

Symmetrical Signals and Bullish Formation

A rare and compelling signal is emerging across both the crypto and traditional markets: both the ETH chart and the Russell 2000 Index are exhibiting the same powerful "Cup-and-Handle" pattern. This bullish continuation pattern signals that both assets are nearing the end of a long consolidation phase and are technically poised for a simultaneous upward breakout. This structural alignment between a traditional stock index and a crypto asset is a strong technical validation of the macro thesis.

The Gold Contrast and Risk Rotation

Furthermore, a significant structural rotation is being signaled by traditional safe-haven assets. Analysts are watching the parabolic price movement of Gold, which often signals a local top. When capital hits its ceiling in traditional safety assets, it triggers the "risk-on switch," forcing money out of defensive positions and into high-growth, high-yield assets.

This confirms the internal signal: the ETH/BTC trading pair is showing signs of having bottomed out. This suggests that capital is already rotating internally, moving from the safer, reserve asset (Bitcoin) toward the high-beta growth engine (Ethereum), to maximize gains in anticipation of the global liquidity surge.

The convergence of a strong technical setup and favorable monetary policy confirms a structural bull case for Ethereum. This is no longer speculative noise; it is an analytical mandate. The market is structurally confirming ETH’s role as the prime asset for capturing liquidity.

By successfully positioning itself as the productive, high-yield alternative to falling bond returns, Ethereum now leads the coming global capital rotation. The structural link to the Russell 2000 has validated its functional maturity as a high-growth, rate-sensitive asset. The only element missing is the final decision from the Federal Reserve to trigger the next decisive breakout.

Cwallet: Your Gateway to a New Era of Crypto Finance

Cwallet, more than a wallet, is your all-in-one gateway to secure crypto management and dynamic trading.In one powerful platform, you can store, swap, earn, and spend over 1,000+ cryptocurrencies across 60+ blockchains. Spend your digital assets like cash with the Cozy Card, while extra tools such as HR bulk management, mobile top-ups, and gift cards make every transaction smoother.

We're leveling up into a comprehensive financial hub — from zero-fee Memecoins and xStocks trading to fast, interactive price-prediction trades like Trend Trade and Market Battle, making crypto trading more accessible, engaging, and fun!

Join millions already reimagining what a crypto wallet can do. Stay cozy, trade smart, and embrace the future of Web3 finance.

Official Link

Official Site: https://cwallet.com

Twitter: https://twitter.com/CwalletOfficial

Disclaimer: The content is for informational purposes only and is not investment advice. Please invest wisely and at your own risk.