What is Impermanent Loss?

Impermanent loss is a temporary loss that you have to bear when the value of an asset you deposit in an AMM reduces as a liquidity provider. There is no hard and fast rule on how much an asset will subside in a pool.

Article Summary:

Impermanent loss is quite a household term in DeFi, so if you’ve been involved in DeFi projects, you would have heard about Impermanent loss once or twice.

Simply put, Impermanent loss is a temporary loss of assets that occurs when you provide Liquidity. It happens due to a change in asset prices, coupled with the actions of arbitrage traders. Typically, the rate of impermanent losses is determined by asset volatility. The more volatile an asset is, the higher the impermanent losses.

Due to the ratio structure of an Automated Market Maker, two pairs A & B in a liquidity pool must maintain an equal (1:1) price ratio. So, when the price of an asset in the pair changes, arbitrage traders profit by balancing the other asset in the pair to ensure the ratio is maintained. This asset reduction or addition causes impermanent losses for Liquidity Providers.

Regardless, people provide Liquidity despite the risk of losing some assets because of the potential profits they can gain by giving Liquidity. These losses are usually substantial enough to cover the impermanent losses.

Introduction:

With the rise and adoption of DeFi protocols, Decentralized Exchanges (DEXs) like PancakeSwap on the BSC network, UniSwap, and SushiSwap on the ETH network have massively expanded in volume and Liquidity. Moreover, unlike Centralized exchanges, where trading fees are monopolized by the exchange, these DEXs enable anyone who can provide assets to become a market maker. In other words, anyone can contribute their assets to offer Liquidity and, in turn, earn trading fees.

There are many concepts and things to know about being a liquidity provider in an Automated Market Maker (AMM), and one of such essential concepts is impermanent loss.

What is Impermanent Loss?

Impermanent loss is a temporary loss that you have to bear when the value of an asset you deposit in an AMM reduces as a liquidity provider. There is no hard and fast rule on how much an asset will subside in a pool; the rate of impermanent loss usually depends on how much an asset changes in price before and after you deposit an asset. The greater the price difference, the more likely you will suffer an impermanent loss.

Liquidity Pools with Stable Coins or Anchor Tokens are less likely to suffer huge losses because of the range of their prices. For example, USDT typically ranges from $0.99 to $1.01; hence, the slippage range is very narrow. So, a liquidity provider in this regard faces less risk of bearing enormous losses. Regardless, a loss isn’t truly “a loss” in crypto investment unless you have withdrawn your deposit.

Why Do People Provide Liquidity When They Face the Risk of Losses?

Undoubtedly, this is the question that pops into your mind. You are right to wonder why people provide Liquidity when they could lose some assets. The short answer is that they gain profit from transaction fees. For example, SushiSwap charges 0.3% on every trade; 0.25% out of this is distributed to Liquidity providers, and 0.05% is allocated to SUSHI token holders.

So, if there is a lot of trading volume in a pool, a liquidity provider can gain massive profits, despite suffering heavy impermanent losses. Hence, investors look toward the vast profits they can make and ignore the impermanent losses. However, it is essential to note that the profit may not cover the losses depending on the pool, deposited assets, and market dynamics.

How Exactly Do Impermanent Losses Happen?

Let us imagine a hypothetical scenario where we have a 50/50 DAI/ETH liquidity pool on SushiSwap. So, to supply Liquidity to this pool, you have to provide DAI and ETH tokens worth the same dollar amount. Let us assume that DAI is $1, and ETH is $5,000.

As a single liquidity provider, let us assume that your budget is $100,000; hence, you have to equally split it between DAI and ETH in a 50/50 ratio, as earlier mentioned. As a result, you are required to provide 50,000 DAI at $1 each ($50,000), and 10 ETH at $5,000 each ($50,000).

Or we can say that 5,000 DAI = 1 ETH, and 50,000 DAI = 10 ETH

Other investors too will provide Liquidity into the pool, so let us assume that there is a total of 500,000 DAI and 100ETH. Hence, your total stake in the Liquidity Pool (LP) is 10%.

However, market conditions are usually volatile. So, let’s assume the Price of ETH rises on a Centralized Exchange like Binance to $6,000, then Arbitrageurs quickly come into play. $1,000 profit per ETH is a lot of money, so the Arbitrageurs will keep adding more DAI to the liquidity pool until Sushiswap prices match Binance and other CEXs.

Remember, the ratio between DAI and ETH in the pool must be equal (1:1), so arbitrageurs do this to profit. So now, the price has changed, and 1 ETH is now 6,000 DAI. So, the ETH is reduced to 83.3. Also, remember that your entire take of the pool is 10%. Hence, your investment will now be 60,000 DAI and 8.33 ETH.

Now here comes the difference. Suppose you held your 50,000 DAI and 10 ETH without investing in the liquidity pool, you would now have $50,000 worth of DAI and $60,000 worth of ETH, a combined $110,000. Instead, you now have $60,000 worth of DAI, and $49,980 worth of ETH, totaling $109,980.

Hence, you would have made $20 more if you had simply hodl your tokens. So, the impermanent loss is $20.

Note that $5,000 to $6,000 is only a 20% increase. The price difference could be more, and as we said earlier, the greater the volatility, the more the impermanent loss. In fact, you may not only miss out on potential profits, but you could lose part of your initial deposit.

Regardless, You can still make a lot of money from transaction fees, usually more than enough to offset the impermanent losses.

How Can You Estimate Impermanent Losses?

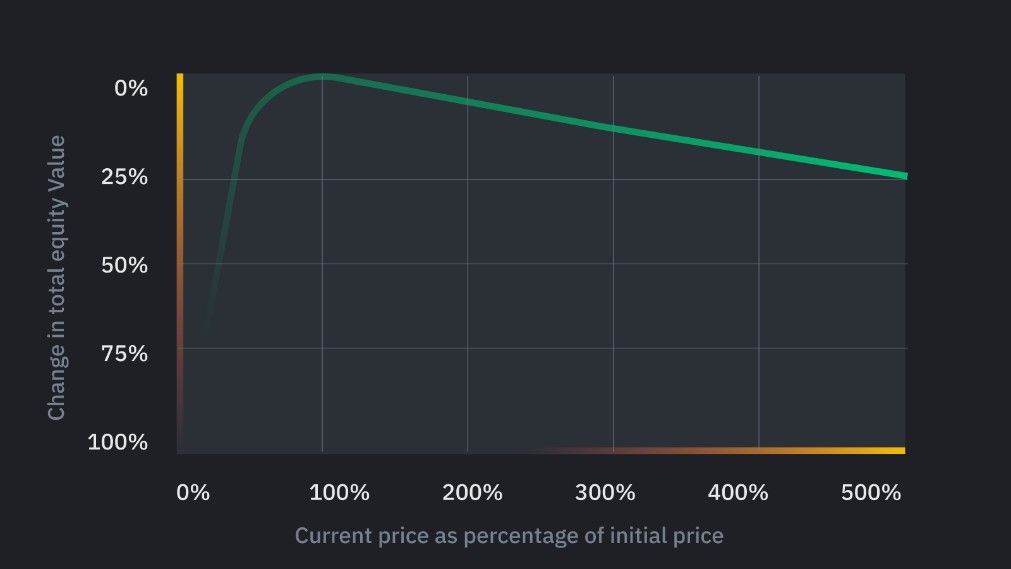

The rate of impermanent loss with respect to price change is demonstrated on the graph below. This doesn’t account for the profits made in transaction fees.

Here, we can compare the estimated loss caused by the change in price after providing Liquidity to simply holding the asset.

1.25x spread = 0.6% loss

1.50x spread = 2.0% loss

1.75x spread = 3.8% loss

2x spread = 5.7% loss

3x spread = 13.4% loss

4x spread = 20.0% loss

5x spread = 25.5% loss

Please Note: Impermanent losses happen regardless of the price change direction, whether an increment or a reduction. Therefore, as long as the price changes for the deposit, there will be impermanent losses.

What Are The Risks of Providing Liquidity to an Automated Market Maker (AMM)?

Again, you haven’t lost any money or asset as long as you haven’t withdrawn your assets from the liquidity pool. The term “impermanent losses” may be somewhat misleading for an outsider. It may be more appropriate to look at it as “false” losses because you can pretty much offset your losses from the profits made in transaction fees.

However, when providing Liquidity to an AMM, you should be wary of the volatility of the assets in the pool. As you can tell from our example, the higher the volatility of the assets, the more impermanent losses you will face. Therefore, it is also advised that you start off depositing a small amount to have a rough idea of what to expect before investing more significant amounts.

Most importantly, you should look for a tested and trusted AMM. DeFi projects make it easy for anyone to modify an existing AMM to create a new one. Be sure to do proper research to eliminate exposure to bugs and theft. You may even lose your assets altogether as your funds may be unrecoverable. Also, you should be wary of pools that offer unrealistically high returns; research properly before investing in them.

Conclusion

The term “impermanent loss” is fundamental for anyone interested in providing Liquidity to AMMs. If necessary precautions aren’t taken, you may suffer higher rates of impermanent losses or even asset forfeiture.

For more beginner tips, as well as detailed guides on cryptocurrency and blockchain technology, do well to visit the Cwallet blog (previously CCTIP blog) and follow our social media communities: