What is A Dead Cat Bounce in Crypto Trading?

a dead cat bounce is a temporary recovery of a market after a prolonged bearish run. This downtrend is interrupted by a short-lived recovery of crypto asset prices and a further continuation of the bearish run.

It is said that “even a dead cat will bounce if it falls from a great height.” However, the bounce of the dead cat is a farce; it is dead and will return to the bottom again. The phrase has since originated on Wall Street and is usually used to describe situations where the market experienced a small upward rally after a huge decline; however, this rally is unsustained, and the market plunges further.

What Is a Dead Cat Bounce?

As explained earlier, a dead cat bounce is a temporary recovery of a market after a prolonged bearish run. This downtrend is interrupted by a short-lived recovery of crypto asset prices and a further continuation of the bearish run.

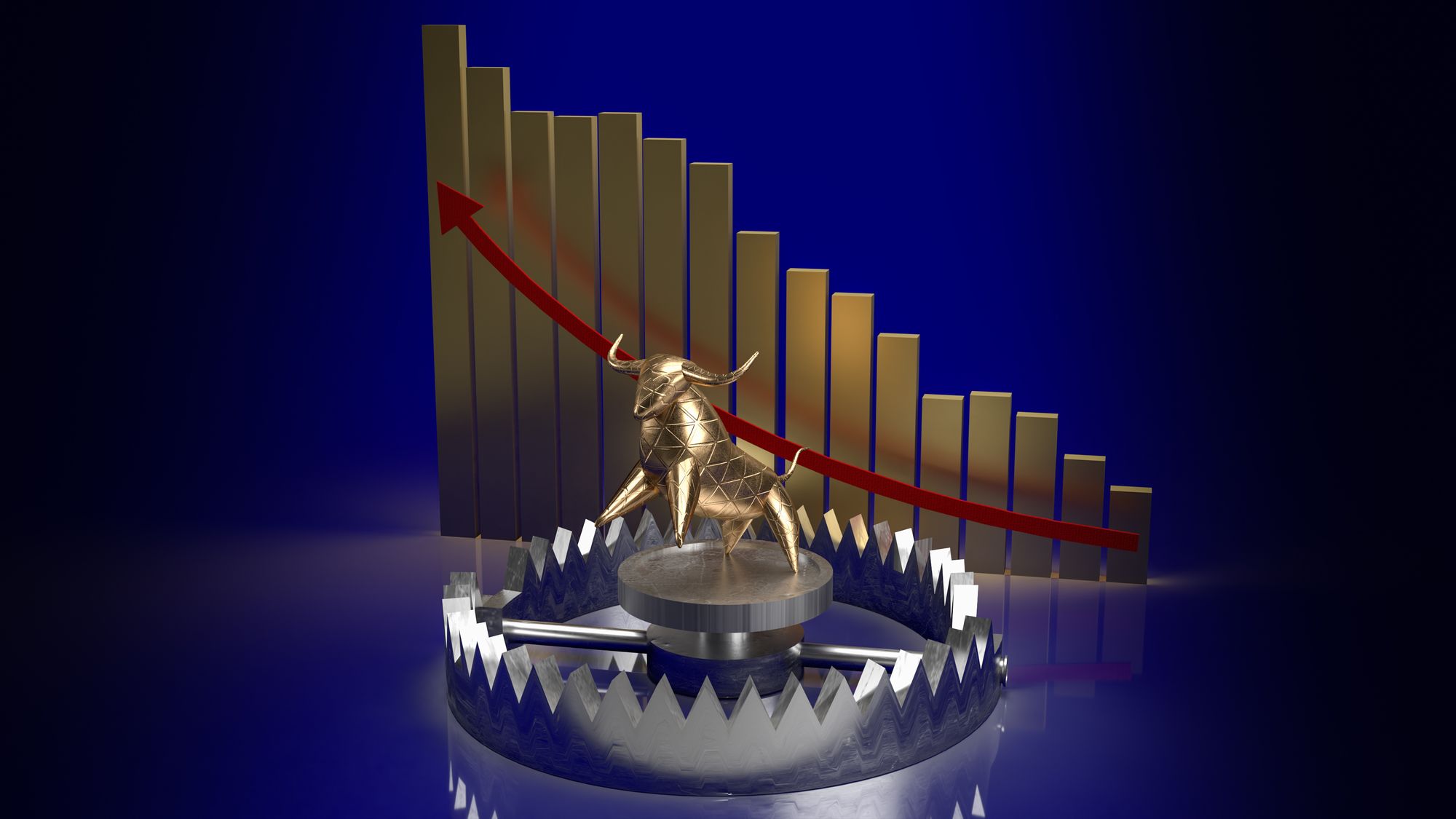

Initially, a “Dead Cat Bounce” is usually confused with a trend reversal; however, investors who might have taken the early initiative to “buy the dip” are caught in the market as the prices refuse to go up; instead, the downward trend continues, breaking existing support levels and creating new lows. As a result, the dead cat bounce could keep investors stuck in a “bull trap,” as they leave open long positions as they believe the trend is reversed, whereas that isn’t the case.

What Does a Dead Cat Bounce Tell You?

A dead cat bounce is a price pattern that can provide information during technical analysis. When discovered, it shows a continuation of the downtrend. It is important to note that the dead cat bounce is only confirmed when the price goes below its previous low (before the bounce).

Although analysts may try to predict the strength of recovery using technical and fundamental analysis, forecasting a dead cat bounce requires impeccable skill, just like identifying a market peak or absolute bottom. Nevertheless, a Dead Cat Bounce is typically identified in hindsight, and even the best technical analysts may not see it coming. Hence, anyone can be trapped.

What Causes a Dead Cat Bounce?

A Dead Cat Bounce is majorly caused by institutional traders who clear their short positions when they erroneously believe the bottom of the market has reached or when they decide to take early profits and exit the market in time. At other times, some investors consider some assets oversold and feel that there isn’t ROI from further shorting the said asset.

Final Takeaway

It is quite a normal occurrence for investors to think that the market is in recovery after experiencing a sustained period of price decline; however, it could simply be a Dead Cat Bounce that puts investors in a bull trap. Hence, buying the dip heavily could lead to huge losses when the trend reversal is only ephemeral. Hence, regardless of how accurate a perceived trend reversal may be, it is safer to invest with dollar-cost averaging (DCA) to mitigate the impacts of a possible loss.

For more beginner tips, as well as detailed guides on cryptocurrency and blockchain technology, do well to visit the Cwallet blog (previously CCTIP blog) and follow our social media communities: