The Four Phases of Cryptocurrency Market Cycles

A crypto market cycle is a period between the lows and peaks of a market, characterized by four unique stages, which greatly indicate the influence of human psychology (fear and greed) in the market

Market cycles aren’t peculiar to the crypto market; all financial markets experience periods of sustained high and low periods, which gives investors different timelines to cash in on their profits and fresh opportunities to re-enter the crypto market. Market cycles are patterns that exhibit human psychology in relation to fear and greed, as well as other external economic factors that impact the demand and supply of crypto assets. Since human psychology isn’t exclusive to crypto trading, market cycles are found in all financial markets.

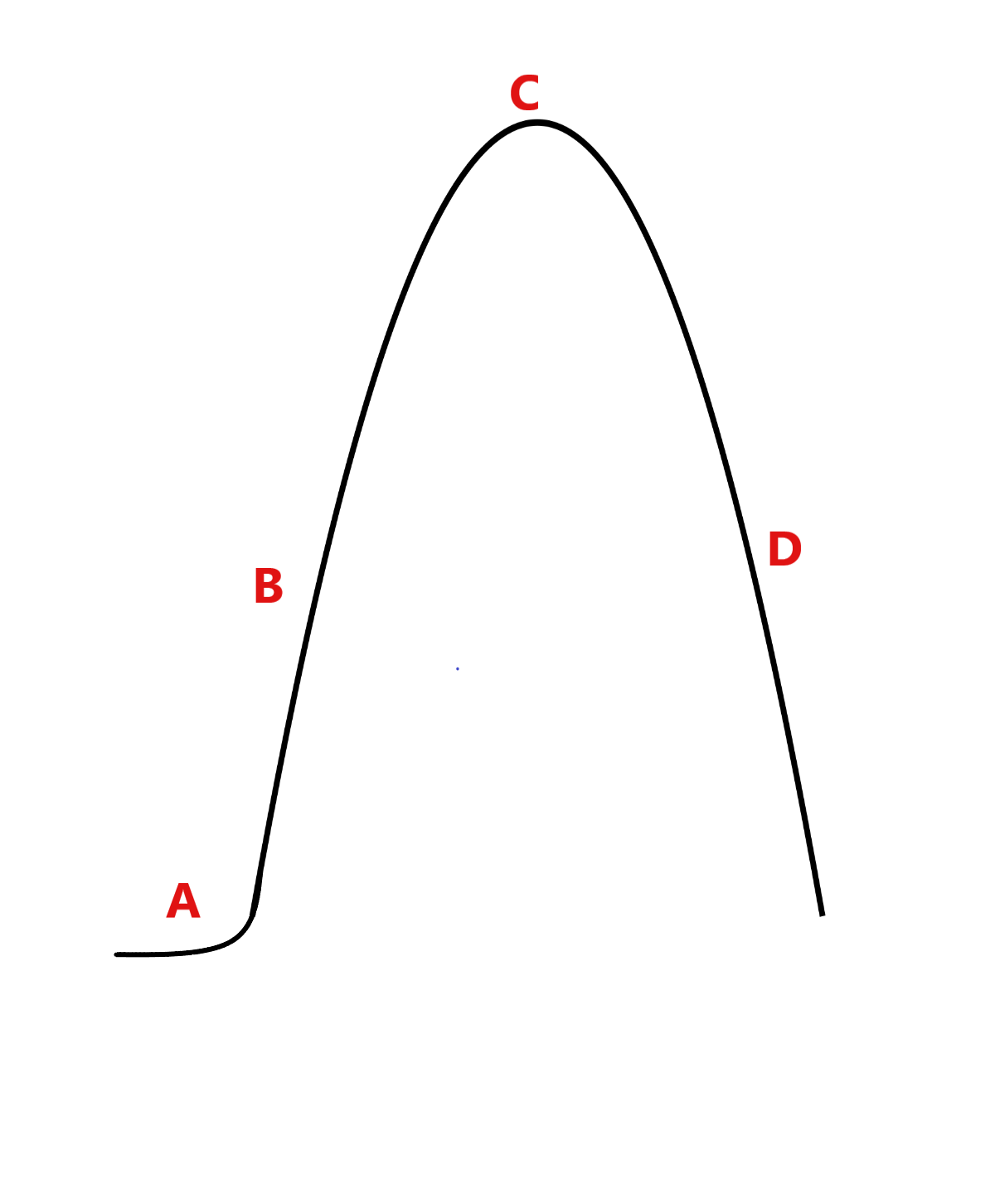

Crypto markets are cyclical, almost like an inverted parabola; this is because prices are determined by market forces, i.e., demand and supply. When demand outweighs supply, assets become scarce and valuable; conversely, when supply outweighs demand, assets become surplus and less valuable. All these happen within the context of a market cycle. After a cycle ends, a new one begins, almost like a fresh opportunity to start from a new bottom (or a higher low) and end at a new peak (or a higher high).

What Is the Crypto Market Cycle?

A crypto market cycle is a period between the lows and peaks of a market, characterized by four unique stages, which greatly indicate the influence of human psychology (fear and greed) in the market. Humans who trade the market are emotional beings; hence, the natural procession of fear and greed largely remains constant. Although some market participants have become more mature in handling the rigors of the volatile market, the majority, as well as new entrants, are caught up in the natural order of fear and greed. Below are the four phases of the crypto market cycle.

A. The Accumulation Phase

The accumulation phase is the period between the end of a market cycle and the start of a new market cycle. It starts after the existing market has bottomed out when the holders who can no longer bear further losses have cut their losses short. Similarly, due to a sustained period of price falls, demand is very low; hence, many assets are undervalued.

Similarly, price action is somewhat stagnant, moving in a horizontal direction, showing relatively low volatility in the market. This signifies neutrality in psychology; there is no further selling pressure after the sustained period of price falls, and new market entrants don’t want to go in too early. At this point, smart investors begin to “accumulate” tokens while they are cheap and undervalued, a.k.a. “buying the dip,” with higher hopes for the crypto assets in the markup phase.

B. The Markup Phase

The markup phase switches the narrative from a neutral stance to a slightly bullish one. Hence, the cautious market entrants who do not want to “go in too early” at the accumulation phase will enter the market; the smart investors have slightly changed the narrative, and this is usually sufficient for the cautious ones who do not want to go in too early; hence, demand increases and the crypto market becomes generally profitable, such that everyone can make profits by merely buying a coin and holding for a few weeks/months.

In this phase, technical analysts take over the market and draw out trends, making more people interested in day trading; hence, market sentiments further tilt towards optimism and greed. Close to the end of the markup phase, the market direction becomes very clear, and then many want to rush in; hence, Fear of Missing Out (FOMO) sets in, and the market volume starts to peak, leading to the distribution phase. At this point, the smart investors begin to exit the market slowly and unnoticed, while the crowd is rushing in due to FOMO. Of course, the huge market volume sees excessive gains in very short periods, attracting media attention, which is the main reason for FOMO.

C. The Distribution Phase

The distribution phase marks the end of the price peaks, which could still see investors making profits; however, the truth is that many early investors are exiting the market, and the bullish sentiments have become slightly neutral. Late entrants are hopeful, while early entrants are taking profits. After some point, the market sentiments start to tilt away from neutral to bearish, and the market lacks new entrants. Hence, at the end of the distribution phase, sellers begin to dominate the market.

At this point, some late investors cut their losses short, while the majority of the market remains emotional, with hopes of making the excessive gains that happened late in the markup phase. Hence, due to their greed and willingness to maintain their position, the void left by the early entrants isn’t quickly noticed. The distribution phase is the exact opposite of the accumulation phase, marked by high volatility. The distribution phase can last for months, long enough for some late entrants to cash in on their profits and for some to lose a major part of their entry capital.

D. The Markdown Phase

As the dwindling demand becomes evident, prices begin to decline, and then Fear, Uncertainty, and Doubt (FUD) take over the market. As prices begin to crash, selling pressure is mounted, and the market shifts towards pessimism. The peak of the markdown phase is noticed when Bitcoin, as the index coin, loses about 50% from its all-time high; then, the market shifts towards extreme fear, and doomsday prophets begin to have a field day predicting new price lows.

In the markdown phase, investors are left with the choices of cutting their losses short or waiting for a new accumulation phase by holding their positions; deciding to HODL is tricky, as a bear market lasts for about 9 months on average; hence, the investor who failed to cash in on their profits, or one who got caught up in a bearish run due to FOMO, will have to make the tough decision of cutting losses, or waiting for about 9 months.

In some cases, cutting losses could be a much better move, as it can preserve some capital, as long as the investor can enter early at the accumulation phase; otherwise, the investor can decide to wait out the bearish run and HODL positions, ignoring the significantly reduced ROI and limited future investment capital.

How Long do Crypto Market Cycles Last?

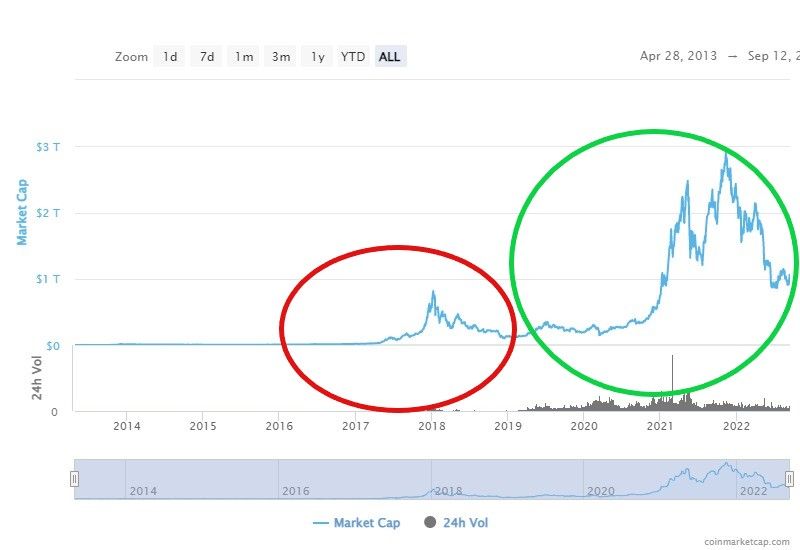

We have had two complete market cycles in the crypto market, which lasted for about four years each (2016-2019 and 2019-2022). At the moment, we are entering a new accumulation phase for a new cycle; hence it may be a good time to ready your investments again.

Given the timelines of the first two cycles, it is safe to say that the expected duration for a market cycle should be around 4 years. Although, given that the crypto market is younger than other financial markets (about 14 years old), some analysts say that future market cycles may be longer due to the lesser volatility of Bitcoin as an index coin.

What Is A Crypto Supercycle?

Sometimes, a “supercycle” could occur when the market experiences an extended markup phase and refuses to quickly enter a markdown phase; this happened in 2020, when the mass adoption saw the crypto market draw in a new influx of investors, so much that the distribution phase was somewhat eliminated for an extended markup phase, before the markdown phase.

Final Takeaway

The inverted parabolic nature of the crypto market is a function of our psychology and reality as humans; hence, the market WILL ALWAYS move in cycles. Hence, it may be wise not to remain ever optimistic about crypto prices going higher; it is expedient to remain aware of market cycles and know that we will experience new highs and lows. It could be dark presently, but the cycle of nature will see the sun shine again. Hence, understanding market cycles will help you keep your emotions, fear, and greed in check while investing in volatile assets.

Always remember to be fearful when others are greedy and greedy when others are fearful.

All information highlighted in this article is informational and should not be taken as financial advice; you are advised to Do Your Own research.

For more beginner tips, as well as detailed guides on cryptocurrency and blockchain technology, do well to visit the CCTIP Blog and follow our social media communities: