Technical Analysis: Identifying Breakouts and Fakeouts

The number one difference between a breakout and a fakeout is the trading volume involved; while conducting your technical analysis, you can see the trading volume at the base of the chart; if there is a significant increment at the breakout point, then you have a good breakout signal

Whenever a crypto trader trades against the trend and ends up being correct, there is an instant gush of satisfactory emotions; it’s a pleasant feeling to correctly predict a change in trend and even more pleasant to act on that prediction and make profits.

When trading breakouts, a trader’s goal is to identify a trend and be on the lookout for a point where the price breaks out of the trend. Breakout trading is enticing because it marks the beginning of a new trend, and traders can ride on a new trend early enough until it wears off. As a result of entering a new trend early, traders can be better poised for major price moves, and increased volatility at this point is a positive metric for the trader that foresaw the trend change.

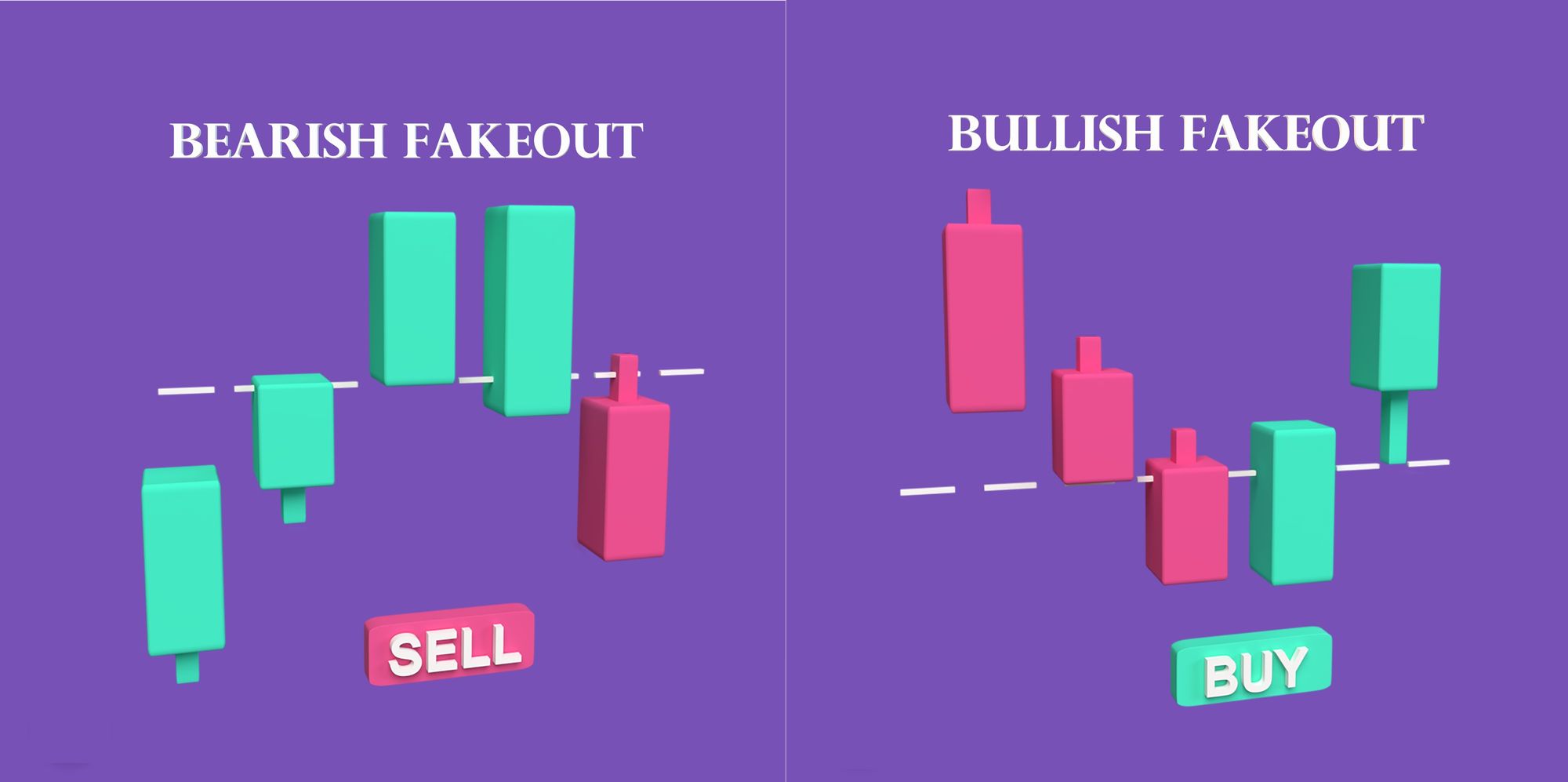

Unfortunately, not all predictions will come out right; hence, despite following a similar to breakouts, “fakeouts” also exist, where it seems as though the price has broken out of the trend, only to make a reversal into the existing zone, hoodwinking traders who attempt to beat the rest of the market by moving in early.

This article intends to help you identify breakouts and fakeouts early enough so that you can better preserve your capital.

What Is a Breakout?

A breakout occurs when the price of a cryptocurrency is moving outside a defined support and resistance zone with increased volume; These zones may be horizontal or diagonal (trend lines) or a mixture of both (triangle patterns).

A breakout trader looks to enter a long position after the price has broken through the resistance ceiling; similarly, they enter a short position after the price has broken below the support. The increased volume leading to breakouts makes them an interesting checkpoint, not only for present trading but for future references.

What Is A Fakeout?

Otherwise referred to as a “false breakout” or a “false break,” a fakeout refers to a situation where the price movement of a cryptocurrency moves out of the defined support and resistance zone, only to take a U-turn back into the zone, leading traders into losses.

Identifying Breakouts and Fakeouts

The number one difference between a breakout and a fakeout is the trading volume involved; while conducting your technical analysis, you can see the trading volume at the base of the chart; if there is a significant increment at the breakout point, then you have a good breakout signal; otherwise, you should be on the lookout for a new signal. To be sure, you can confirm if there is a significant change in trading volume by visiting a slightly lower time frame to observe the volume.

Confirming A Breakout

The best way to confirm the strength of a breakout is to see if support has become resistance in a bearish breakout or resistance has become support in a bullish breakout; this means that the price has broken out of that zone and won’t make a U-turn back there.

To get this confirmation, traders usually wait for a “retest,” where the price movement backtracks towards the corresponding support or resistance that was just broken; however, on getting to this support or resistance, the price continues an upward movement with increased volume; this confirms the strength of the new trend, and the newly flipped support/resistance.

Safety Practices When Trading Breakouts

Although breakout trading is a “low risk” adventure, where the result is seen early enough, it is important to approach it safely by:

1. Using strong support and resistance zones: When making technical analysis with support and resistance zones, always look for strong levels; as a rule of thumb, the stronger the support/resistance level, the better the outcome of the analysis.

2. Waiting for a confirmation: When you see the breakout move and a corresponding increase in trading volume, it isn’t wise to just “jump in” as you could get wrongfooted; instead, it is better to wait for a few candles after the breakout, and even better, to wait for a retest confirmation on the same support/resistance level, to show a stronger level of analysis.

3. Setting stop losses: Whether you enter the trade early or late, it is important to set stop losses, as a perfect analysis could still be ruined by sudden fundamental reports. If you enter the trade immediately after the breakout, then you should set your stop loss slightly below the resistance (or slightly above the support) so that a retest won’t take out your trade.

Final Takeaway

Breakout trading relies on volatility, as it depends heavily on the increase in trading volume while leaving the zone. Although with increased volatility, huge quick profits are experienced, it could also lead to rapid price movements in the market, leading to fear and greed; as a result, it is important that you stick with your trading plan, follow your analysis, and have a good exit plan when things are not going your way.

For More Beginner Tips, As Well As Detailed Guides On Cryptocurrency And Blockchain Technology, Do Well To Visit The Cwallet Blog (Previously CCTIP Blog) And Follow Our Social Media Communities: