Key Strategies To Hedge Against Cryptocurrency Volatility and Trading Risks

Given the high volatility and the potential for both significant gains and losses, effective risk management is crucial for anyone involved in cryptocurrency trading. Risk management involves identifying, assessing, and prioritizing risks

The allure of the cryptocurrency market lies in its potential for substantial returns, but this opportunity comes hand-in-hand with significant volatility and risk. Unlike traditional financial markets, cryptocurrencies operate in a decentralized, highly dynamic environment where prices can fluctuate dramatically within short periods.

The volatility of the crypto market is caused by various reasons. One is that the value of cryptocurrencies is heavily influenced by market sentiment and speculative trading. Investors often react to news, rumors, and hype, leading to sharp price movements. Several other reasons could cause a sharp increase or decrease in prices of cryptocurrencies. For traders and investors, surviving the turbulent nature of cryptocurrencies requires an understanding of market mechanics and also a robust risk management strategy.

See Also: The Crypto Volatility Index - What Is It and How Can It Help You?

Importance of Risk Management in Cryptocurrency Trading

Given the high volatility and the potential for both significant gains and losses, effective risk management is crucial for anyone involved in cryptocurrency trading. Risk management involves identifying, assessing, and prioritizing risks, followed by the application of resources to minimize, control, and monitor the impact of those risks.

- Preservation of Capital: Effective risk management helps protect an investor's capital from substantial losses. By setting stop-loss orders, diversifying investments, and employing hedging strategies, traders can limit potential losses.

- Emotional Discipline: Volatility can provoke emotional responses, leading to impulsive and irrational trading decisions. A solid risk management plan can help traders maintain emotional discipline, sticking to their strategies even in the face of market turbulence.

- Long-Term Success: Consistently applying risk management techniques can increase the likelihood of long-term success in the cryptocurrency market. It enables traders to survive downturns and capitalize on market opportunities with a well-balanced approach.

- Adaptability: The cryptocurrency market is dynamic, with new developments emerging frequently. Effective risk management involves staying informed and adapting strategies to changing market conditions, regulatory environments, and technological advancements.

Hedging Strategies and Risk Management Techniques

- Diversification: Diversification is a fundamental strategy for managing risk, and it involves spreading investments across various assets to reduce the impact of any single asset's poor performance on the overall portfolio.

By holding a range of cryptocurrencies, investors can mitigate the risk associated with any individual cryptocurrency's volatility. For example, if one cryptocurrency experiences a significant decline, gains in other cryptocurrencies can offset these losses.

Cryptocurrencies often serve different purposes. Bitcoin is primarily seen as a store of value, while Ethereum is known for its smart contract capabilities. Investors can benefit from the unique value propositions of each asset by diversifying across different crypto asset classes. - Investing in Stablecoins: Stablecoins are a type of cryptocurrency designed to maintain a stable value relative to a reference asset, usually a fiat currency like the US dollar. During periods of high market volatility, investors can convert volatile cryptocurrencies into stablecoins to preserve their value. This provides a stable store of value without exiting the cryptocurrency ecosystem.

Stablecoins serve as a convenient medium of exchange for trading other cryptocurrencies. With stablecoins, traders can quickly move in and out of positions without the need to convert to fiat currency, reducing exposure to price swings. - Stop-Loss Orders: A stop-loss order is a pre-set order to sell a security when it reaches a specific price. In cryptocurrency trading, stop-loss orders are used to automatically sell a cryptocurrency when its price drops to a predetermined level. This automated action helps traders manage risk by limiting potential losses without the need for constant market monitoring.

The primary purpose of a stop-loss order is to protect trading capital. By setting a limit on the maximum acceptable loss, traders can avoid catastrophic losses that could deplete their investment portfolio. Stop-loss orders enforce discipline by adhering to a predetermined exit strategy. This prevents traders from holding onto losing positions in the hope of a market rebound, which can often lead to larger losses. - Position Sizing: Position sizing refers to determining the amount of capital to allocate to a specific trade. Allocating a sensible portion of the portfolio to each trade helps manage risk and prevents significant losses from a single adverse move in the market.

By not overcommitting to one trade, traders can diversify their investments across multiple assets, reducing overall portfolio risk. Adjust position sizes according to market conditions. During periods of high volatility, reducing position sizes can mitigate risk, while more stable market conditions might allow for larger positions.

Traders could also regularly review and adjust position sizes as the portfolio grows or as market conditions change. This ensures that position sizing remains aligned with the trader's evolving risk tolerance and market environment.

Using Automated Bots To Mitigate Risks

Automated trading bots are software programs that use algorithms to execute trades on behalf of traders. These bots can operate 24/7 and make trading decisions based on predefined rules and strategies, eliminating the need for constant human supervision. In the cryptocurrency market, where prices can fluctuate rapidly and around the clock, automated trading bots have become increasingly popular among traders looking to optimize their trading performance.

See Also: What Are Telegram Trading Bots? How Do They Work?

Bots execute trades consistently according to predefined strategies, eliminating the emotional and psychological factors that can lead to poor decision-making. This consistency helps ensure that trading plans are followed rigorously, even during periods of high volatility. Automated bots can execute trades much faster than human traders. This speed is crucial in the fast-paced cryptocurrency market, where timely execution can make a significant difference in profitability.

The cryptocurrency market operates non-stop, making it challenging for human traders to monitor and react to market movements at all times. Bots can trade around the clock, capturing opportunities and managing risks even when the trader is not actively monitoring the market. Many trading bots come with built-in risk management features, such as stop-loss and take-profit orders, trailing stops, and position sizing rules. These features help protect capital and manage exposure to risk automatically.

Safe Trading with Cwallet Telegram Bots

Cwallet is a holistic crypto wallet offering both custodial and non-custodial wallet options to its users. Supporting over 900 cryptocurrencies, Cwallet boasts several features that make trading easy and stress-free.

Cwallet offers its users an opportunity to use its Telegram chatbots which allows traders to complete trades in a matter of seconds with simple command prompts. Getting access to the Telegram Chatbot is easy. All of have to do is to create a Cwallet account and link your Telegram account to your Cwallet account.

Once this is done, you can manage and trade your crypto assets from your Telegram chat window. Cwallet chatbots allow you to do all that you would normally be able to do with the Cwallet app. Beyond sending, receiving, and swapping assets, you can also buy and sell cryptocurrencies easily with your Telegram chatbot.

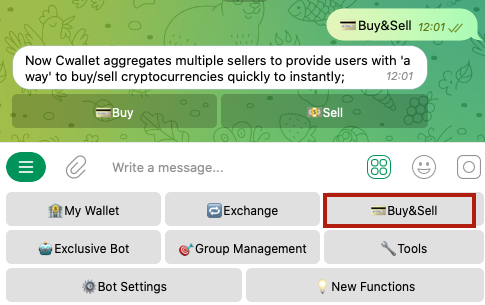

For example, to buy or sell crypto via Telegram bots, you can easily initiate a chat with the bot and click “start,” you’ll be provided with a small menu, from which you can click “Buy and Sell,” as seen below.

The Cwallet bot is designed to help traders mitigate their risks by having easy access to buying, selling, swapping, and trading cryptocurrencies.

Final Thoughts

The unique characteristics of the cryptocurrency market, such as its high volatility, 24/7 operation, and susceptibility to rapid changes due to news and regulatory developments, make effective risk management paramount. A comprehensive risk management approach combined with a commitment to staying informed and adaptable is essential for success in cryptocurrency trading.

Choosing the right trading bot is crucial for maximizing the benefits of automated trading while minimizing potential risks. It is advised that traders choose a trading bot that aligns with their trading goals and risk management strategies. Cwallet Telegram bot is one such bot. It is easy to use and intuitive for traders of all experience levels.

Sign up on Cwallet and enjoy all that Cwallet Telegram bots have to offer!