I Saved Money On Taxes By Using Crypto To Pay My Domestic Staff

I looked into options for handling workers' payments...after using all of these payment methods & still being unable to keep up with tax records. When I mentioned my payment issue at a family gathering, a relative told me how her company has shifted to paying staff in cryptocurrency...

Employee management is not just for business owners. In truth, managing domestic workers as a household employer should be the same as managing corporate employees. In comparison, employing domestic workers is just as challenging as hiring corporate employees, only that the conditions for employment are vastly different and the output required for a household is not as profit-oriented as that of a corporate organization.

However, one major challenge I experienced with handling domestic help was the financial aspect –paying salaries. Despite how simple it may seem, it is nonetheless complicated because both the worker and I have some responsibilities that must be considered. This makes household employment different from other forms of work.

Unlike an independent contractor who gets paid off for services rendered, a household worker is paid weekly or monthly for providing services as determined by the employer. However, I needed to address various obligations and tax compliance concerns while paying my employees. To be honest, household employment is exhausting for a non-profit organization. But unfortunately, whether or not it is a profitable endeavor is irrelevant to the tax system.

Tax Compliance With Paying Household Workers

The most challenging aspect of becoming a household employer is paying the wages of domestic employees. In addition, as required by the household labor law, I must carefully evaluate various tax compliance difficulties.

For example, all domestic workers must submit paperwork, their work hours must be documented, and their wages must be accurately computed while employment taxes are deducted from their income. There is a lot of work to be done. And failing to do so would surely lead to Internal Revenue Service audits, which would carry a heavy penalty.

On the other hand, if I decided to make payments off the books, it would be damaging to the employability of my domestic staff since they would be unable to establish an employment history without a tax record. Unfortunately, the consequences of paying off the books are not worth it because I will still have to pay back all the taxes and interest and face any other type of penalty. This would, indeed, be a penny-wise and pound-foolish option to consider.

In addition to running workers' paychecks each month, calculating and deducting Social Security, Medicare, and federal and state unemployment taxes, as well as filling out and filing federal, state, and local tax forms, are all tedious parts of the job that must be done.

In fact, I looked into several payment methods to be sure that I complied with all of the rules about domestic employees and labor legislation.

Various Mode Of Payment I Tried

Cash

Paying domestic workers in cash is the easiest and most common payment method. However, one of the most challenging aspects of paying with cash is that I must constantly keep records, as failure to file the correct tax record would draw suspicion from the tax agency. In addition, I am required to pay Social Security, Medicare, and Federal Unemployment taxes—often referred to as "nanny tax"—when I pay workers a salary of more than $2,000 in cash. So, this puts me at the risk of tax audits, which are always time-consuming and costly.

Paycheck

To prevent using cash, I decided to draft checks on paydays so that employees could utilize the check-cashing service to get their earnings. However, given the number of employees I would issue the check to, it is time-consuming. And on multiple occasions, employees have complained of misplacing their paychecks.

Direct Deposit

Direct deposit is the most convenient method because it eliminates my need to physically handle workers' earnings. However, setting up direct deposit takes time, and other expenses are involved - set-up fee, monthly fee, and expedited fee. In addition, a transaction fee is charged for each worker's transaction executed.

On the other hand, I looked into options for handling workers' payments without doing so much after using all of these payment methods and still being unable to keep up with tax record keeping and filing. Thankfully, I discovered household payroll services that handle tax compliance and disburse wages to domestic workers.

Utilizing Household Payroll Service

Payroll services undoubtedly exist to automate the payment process. They seem to be one of the most acceptable ways for me to avoid the hassle of submitting taxes and maintaining tax records, as the payroll software is designed with such compliance.

Unfortunately, after researching the best payroll service I can adopt, I discovered how costly it is to manage and the various limitations of the service. For example,

- It's costly to set it up.

- There's a monthly renewal fee.

- The payroll takes two or more processing days.

- Requires additional cost to add new workers to the system.

Given this, using the household payroll service was out of the question.

As a result, I kept looking for alternatives and asking myself, "What is the ideal method to pay my domestic workers?" "Which payment method is the most tax-efficient?" "How can I save money on payment transaction fees?"

Surprisingly, when I mentioned my payment issue at a family gathering, a relative told me how her company has shifted to paying staff in cryptocurrency. She went on to explain why I should use cryptocurrency to pay my domestic employees, claiming that they are unregulated because cryptocurrencies are decentralized and not backed by a centralized authority or a government. A central bank cannot guarantee its supply. So, adopting cryptocurrencies avoids many taxes associated with traditional payment systems.

Knowing this, I researched more on cryptocurrencies and how to use them effectively to pay my workers. After much study, I discovered I needed a crypto wallet to get started. Then I found the Cwallet platform (previously CCTip), which let me pay my domestic workers at once.

Paying My Domestic Workers With Cwallet Bulk Payment

Interestingly, creating a Cwallet account was simple; all required to get started was to add my mobile phone or third-party sites like Twitter, Telegram, and Discord. There was no time-consuming sign-up, KYC, or other excessive verification procedures.

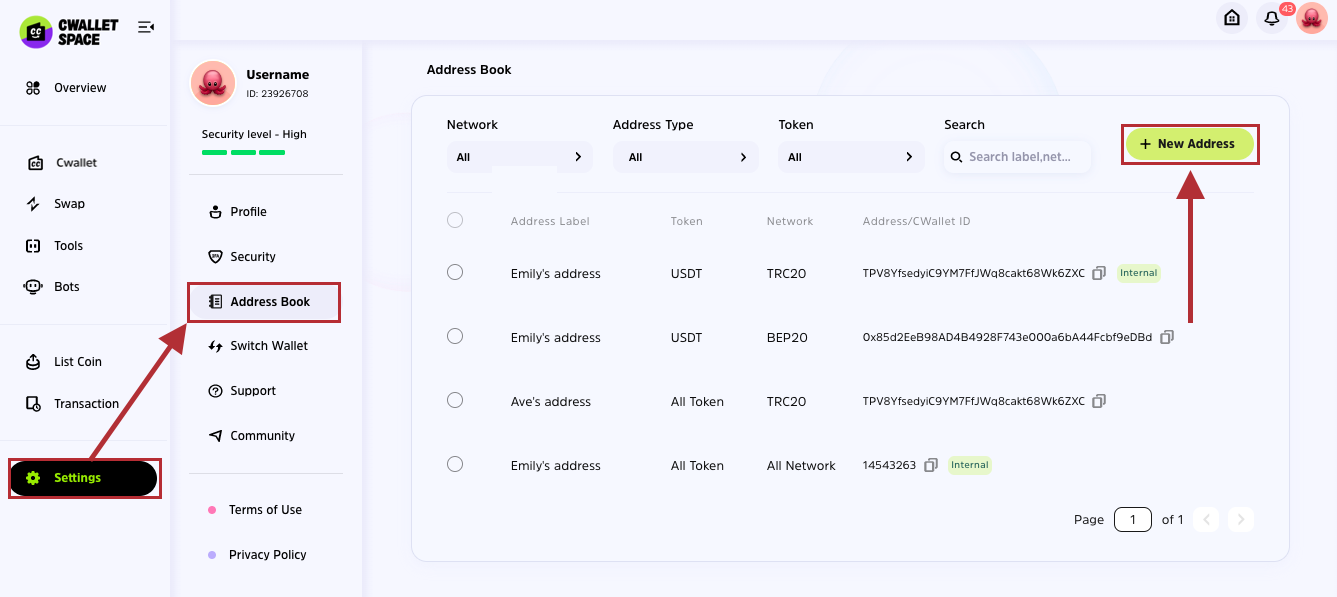

Afterward, I created an address book to keep track of all of my workers' wallet addresses. With the Cwallet address book functionality, I could categorize my workers' payments by token type, address label, or network. In addition, I could easily add a new worker's address and view all addresses in one glance with their corresponding transaction network.

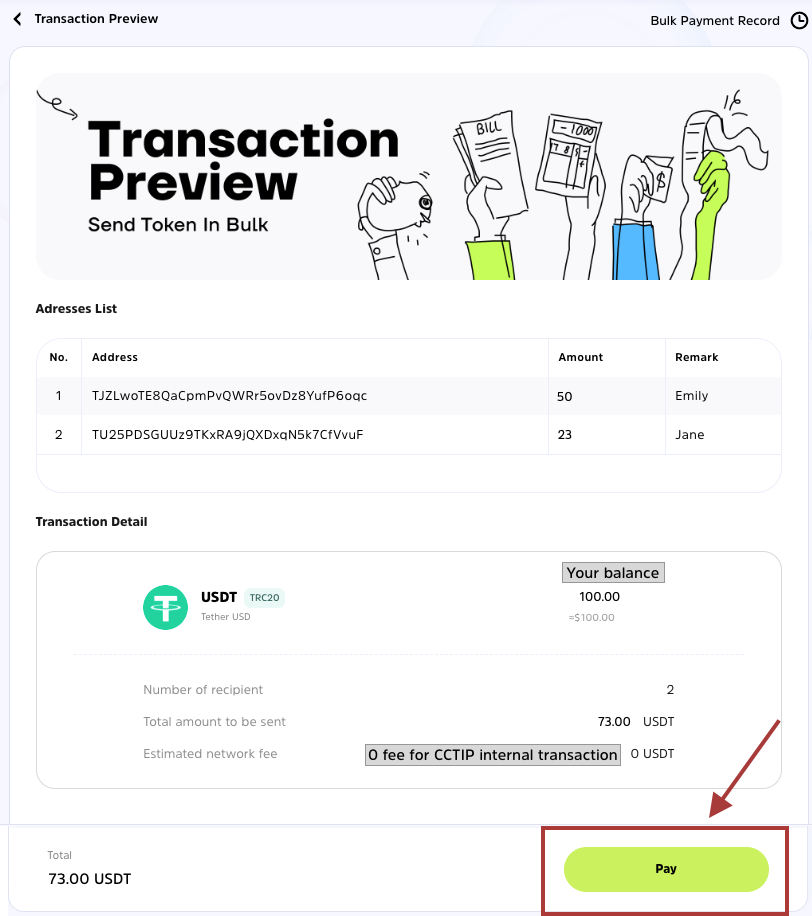

Once all the addresses have been included, I can pay all workers on the list without incurring transaction fees using the Cwallet bulk payment.

That's all! It was super simple, quick, and saved me a lot of time.

There was no turning back from using the Cwallet bulk payments. It saves me time and transaction costs. In addition, I saved a significant percentage on household tax by using the Cwallet service instead of paying workers with fiat money. This significantly helped my finances and gave me more purchasing power.

You can't go wrong with using the Cwallet bulk payment for paying your domestic workers or any bulk transactions. Follow this step-by-step procedure for a more detailed guide on how to use Cwallet bulk payment.

It is easy, instant, and secure. Remember, you can get a Cwallet account with your mobile number or third-party networks such as Twitter, Telegram, Discord, and Reddit to save money on transactions.

Cwallet is a unique cryptocurrency wallet that combines custodial and non-custodial features.

It provides complex crypto needs of individuals or businesses through tools like the tip code, airdrop game, giveaway tool, mobile refills, bulk payment, request invoice, payment button, etc. It is more than just a cryptocurrency wallet where users can send, receive, buy, sell, or hold and swap.

What's more?

Cwallet does not charge any deposits, withdrawals, and token swap fees. Therefore, using Cwallet is absolutely FREE!

So, what are you waiting for?

Download Cwallet NOW!