Cwallet Weekly Crypto Express | Uptober Breakout: $2.2B ETF Inflow Confirms New Cycle

On-chain profitability has surged, with 97% of supply now in profit. While elevated profit levels often precede consolidation, realized profits remain contained, suggesting an orderly rotation rather than distribution pressure.

Executive Summary

- On-chain profitability has surged, with 97% of supply now in profit. While elevated profit levels often precede consolidation, realized profits remain contained, suggesting an orderly rotation rather than distribution pressure.

- The $117K supply cluster has been flipped into support, marking a structural pivot where small and mid-sized holders continue to accumulate, offsetting moderate profit-taking from larger entities.

- Bitcoin has broken to new all-time highs near $126K, driven by renewed spot demand and record ETF inflows exceeding $2.2B. The surge in institutional participation has lifted both price and market activity, with spot volumes reaching multi-month highs as Q4 begins.

- Derivatives markets expanded sharply during the rally, with futures open interest and funding rates rising as late longs entered. The current pullback is now testing this leverage, helping to reset positioning and restore balance.

- In the options market, implied volatility has lifted, skew turned neutral, and call-heavy flows dominate. Momentum remains strong, but bullish positioning is becoming increasingly crowded.

On-Chain Outlook

Accumulation Resurgence

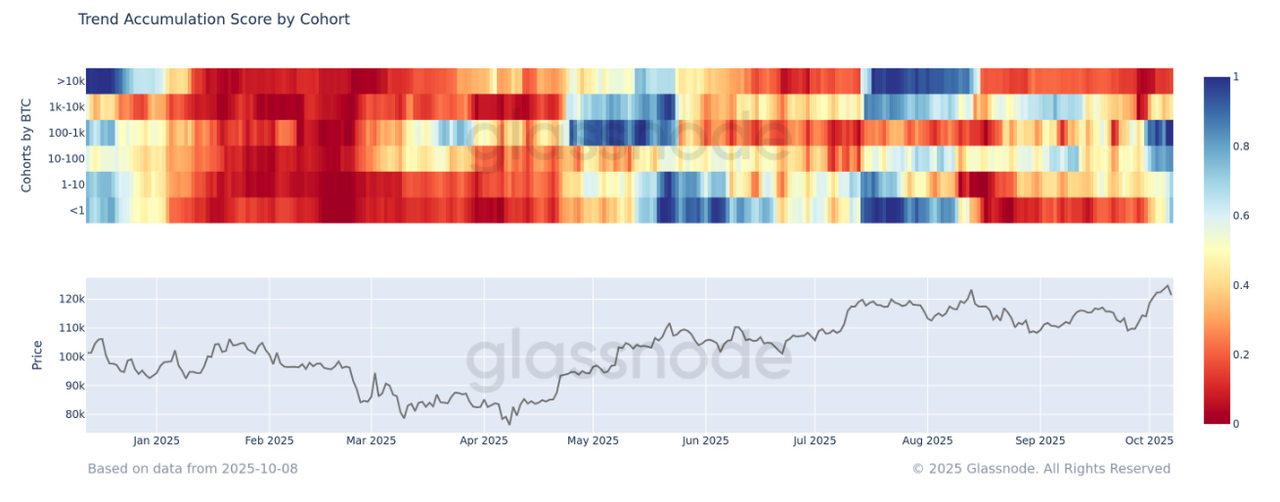

Following Bitcoin’s breakout to new highs, we turn to the Trend Accumulation Score to evaluate underlying demand strength. This metric measures the balance between accumulation and distribution across wallet cohorts.

Recent readings indicate a clear resurgence in buying, driven by small to mid-sized entities (10–1k BTC), which have accumulated consistently over the past few weeks. Meanwhile, whale distribution has eased from earlier in the year. The alignment among mid-tier holders points to a more organic accumulation phase, adding structural depth and resilience to the ongoing rally.

Resistance Flipped into Support

Building on the accumulation trend, Bitcoin’s rally to a new all-time high has lifted nearly all circulating supply back into profit. The Cost Basis Distribution Heatmap shows limited structural support between $121k and $120k, with a stronger cluster near $117k, where roughly 190k BTC were last acquired.

While price discovery phases inherently carry the risk of exhaustion, a potential pullback into this region could invite renewed demand as recent buyers defend profitable entry zones, marking a key area to watch for stabilization and a resurgence of momentum.

Mild Profit-Taking

As Bitcoin enters a price discovery phase, assessing the degree of profit realization helps gauge whether the rally remains sustainable. The Sell-Side Risk Ratio, which measures the value of realized profits and losses relative to total realized value, serves as a proxy for investors’ willingness to spend their coins.

Recently, this ratio has rebounded from its lower bound, signalling a rise in profit-taking after a quiet period. Although still well below historical extremes tied to cycle tops, this uptick indicates that investors are locking in gains in a measured fashion. Overall, selling remains controlled and consistent with a healthy bullish phase, though continued monitoring is warranted as prices advance.

Spot and Futures Analysis

ETF Flows Drive Bitcoin to New Highs

Shifting focus from on-chain dynamics to market demand, Bitcoin’s breakout to new all-time highs near $126k has been underpinned by a sharp resurgence in U.S. spot ETF Inflows.

Following September's redemptions, more than $2.2B has poured back into ETFs within a single week, marking one of the strongest buying waves since April. This renewed institutional participation has absorbed available spot supply and strengthened overall market liquidity. Seasonally, Q4 has historically been Bitcoin’s strongest quarter, often coinciding with renewed risk appetite and portfolio rebalancing.As broader markets tilt toward higher-beta assets such as crypto and small caps, sustained ETF inflows through October and November could provide a durable tailwind, anchoring confidence and supporting prices into year-end.

Spot Volume is Back

With ETF inflows reigniting demand, trading activity in the spot market has surged in tandem. Daily Spot Volume has climbed to its highest levels since April, confirming renewed market participation and deeper liquidity.This uptick reflects growing confidence behind Bitcoin's breakout to new highs. Sustained volume will be essential for validating the rally’s strength, as fading turnover after major advances has historically preceded short-term exhaustion and corrective phases.

Leverage Build Up

Following the surge in spot activity, the futures market has also heated up. Future Open Interest has risen sharply, setting new highs as Bitcoin broke above $120k. This expansion indicates a wave of leveraged long positions entering the market, a setup that often fuels short-term volatility. Periods of rapid OI growth typically resolve through liquidations or brief cooling phases, allowing excess leverage to unwind and positioning to reset before the next sustainable trend can form.

Funding Rates Heat Up

As futures open interest expands, Funding Rates have climbed in parallel with Bitcoin’s advance to new highs. Annualized funding now exceeds 8%, signalling elevated demand for leveraged long exposure and a rise in speculative activity.

Although not yet at overheated levels, sharp increases in funding often precede short-term cooling as leverage is flushed out. Historically, such phases result in brief pullbacks or profit-taking before the market can re-establish a more balanced structure.

Conclusion

Bitcoin’s breakout above the $114k–$117k supply cluster and new all-time high near $126k highlights renewed market strength supported by mid-tier accumulation and easing whale distribution. On-chain data point to key support between $117k and $120k, where nearly 190k BTC last changed hands, a zone likely to attract dip buyers if momentum cools.

In the spot and futures markets, ETF inflows exceeding $2.2B and surging volumes confirm strong institutional demand, although rising leverage and funding rates above 8% introduce short-term fragility.

Meanwhile, options markets show higher implied volatility, neutral skew, and call-heavy positioning, signalling constructive sentiment but a more crowded landscape.

Together, these signals outline a robust yet maturing uptrend, one that remains supported but increasingly sensitive to profit-taking and leverage resets as Bitcoin navigates price discovery.

Cwallet: Your Gateway to a New Era of Crypto Finance

Cwallet, more than a wallet, is your all-in-one gateway to secure crypto management and dynamic trading.

In one powerful platform, you can store, swap, earn, and spend over 1,000+ cryptocurrencies across 60+ blockchains. Spend your digital assets like cash with the Cozy Card, while extra tools such as HR bulk management, mobile top-ups, and gift cards make every transaction smoother.

We're leveling up into a comprehensive financial hub — from zero-fee Memecoins and xStocks trading to fast, interactive price-prediction trades like Trend Trade and Market Battle, making crypto trading more accessible, engaging, and fun!

Join millions already reimagining what a crypto wallet can do. Stay cozy, trade smart, and embrace the future of Web3 finance.

Official Link

Official Site: https://cwallet.com

Twitter: https://twitter.com/CwalletOfficial

Disclaimer: The content is for informational purposes only and is not investment advice. Please invest wisely and at your own risk.