Cwallet Weekly Crypto Express | BTC Stuck in Limbo

Bitcoin remains in a mild bearish phase, trading between $97K and $111.9K, with resistance near $116K marked by top-buyers’ supply cluster.

Executive Summary

- Bitcoin remains in a mild bearish phase, trading between $97K and $111.9K, with resistance near $116K marked by top-buyers’ supply cluster.

- Seller exhaustion and renewed accumulation near $100K provide short-term support but lack strong follow-through demand.

- A dense supply cluster between $106K–$118K continues to cap rallies as investors exit near breakeven.

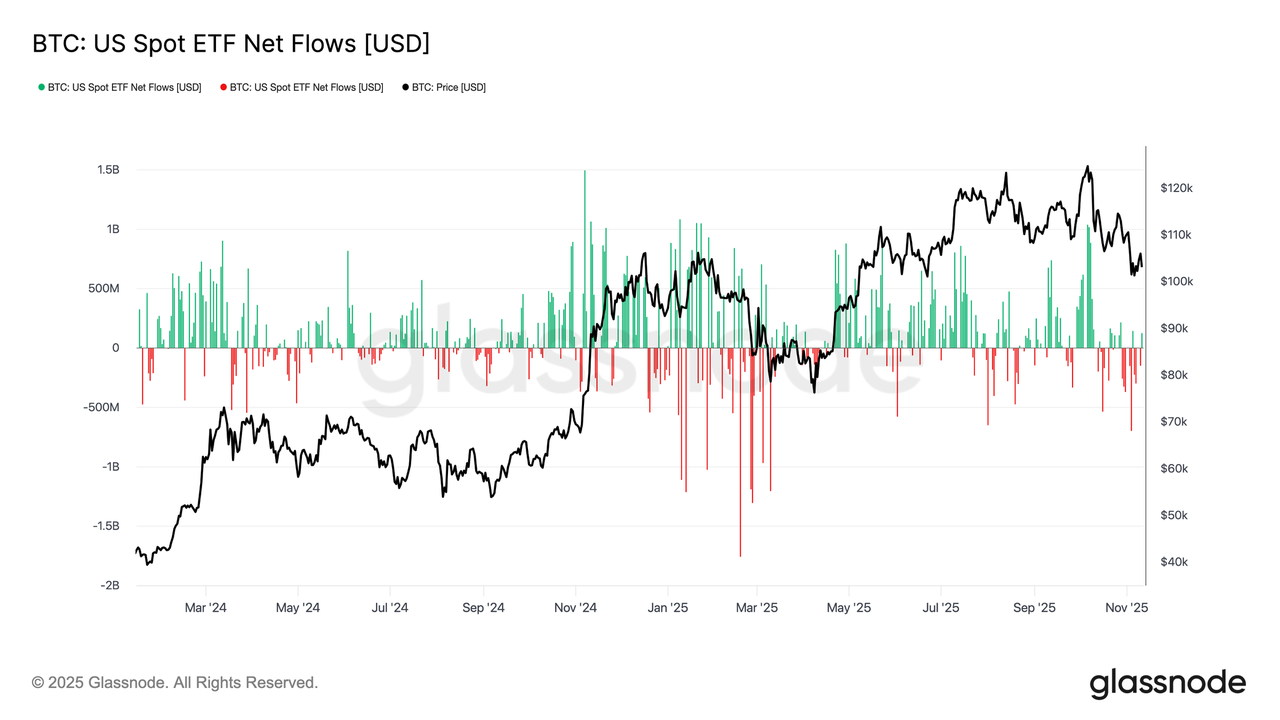

- ETF flows have turned modestly negative, reflecting fading institutional demand and a cautious risk appetite.

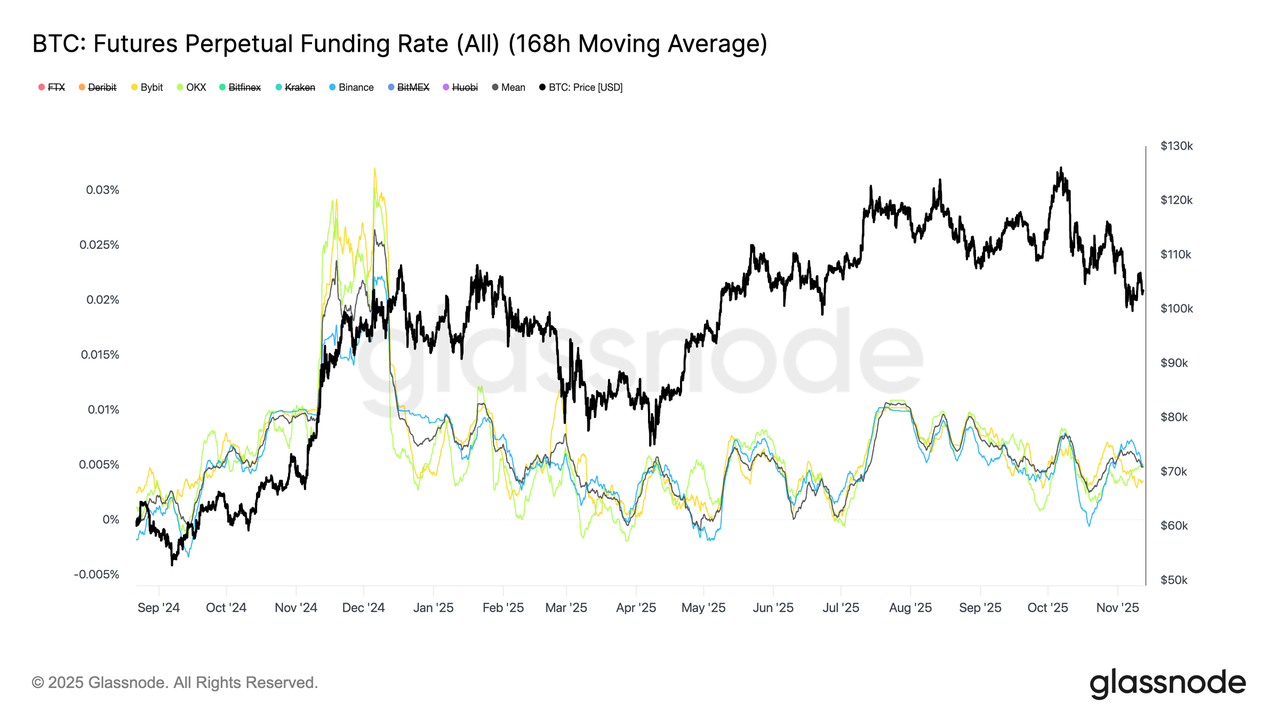

- Futures markets show muted funding rates and low open interest, signalling subdued speculative activity across both Bitcoin and altcoins.

- Options traders maintain a defensive stance, with put protection concentrated around $100K, while the 25-delta skew remains a key gauge for sentiment shifts.

Overall, the market is consolidating within a defined range, awaiting stronger inflows or macro catalysts to break out of the current equilibrium.

Over the past week, Bitcoin briefly slipped below $100K, extending the broader downtrend that has persisted since early October. This move pushed the market into a mild bearish regime, with prices now trading beneath the short-term holder cost basis.In this edition, we analyze the forces driving the rebound toward $106K using on-chain cost-basis models and accumulation–distribution dynamics. We then pivot to off-chain indicators, exploring ETFs, futures markets and options market sentiment to assess whether this recovery reflects genuine demand or a short-lived relief rally.

On-chain Insights

Grinding Lower

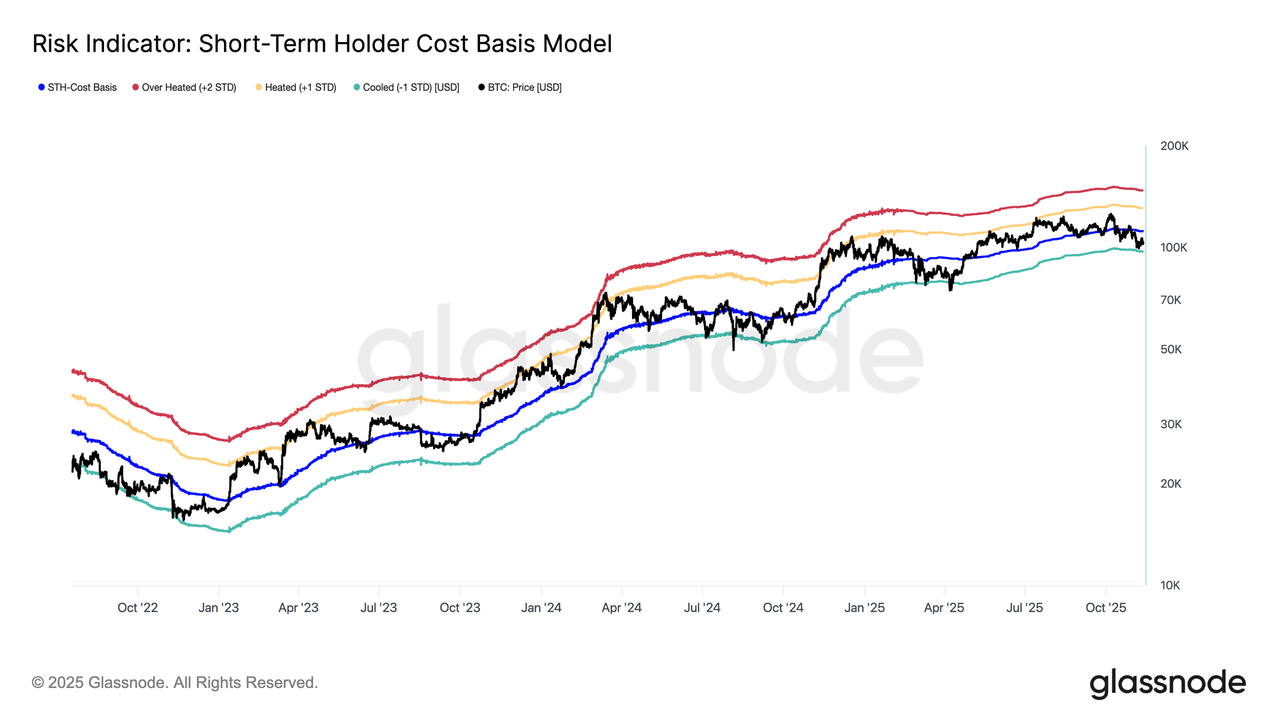

Since early October, with Bitcoin breaking below the short-term holder cost basis (🔵), a range suffering from the lack of conviction and low liquidity has been confirmed. Since then, price action has trended lower, approaching the -1 STD band near $97.5K.This recent drawdown resembles the contraction phases seen during June–October 2024 and February–April 2025, where prices oscillated within a defined lower range before recovery. Consequently, unless Bitcoin reclaims the short-term holder cost basis (~$111.9K) as support, the probability of revisiting the lower bound of this range remains elevated.

Seller Exhaustion Near $100K

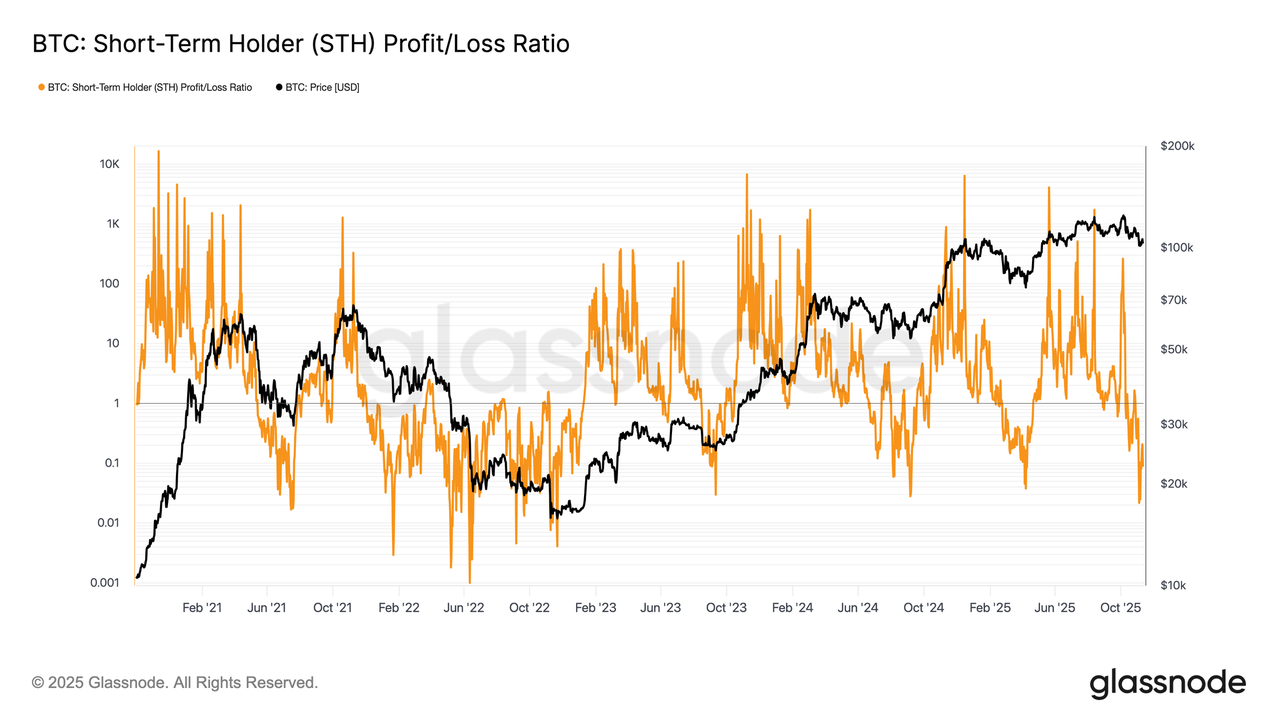

Building on this structural setup, the sub-$100K zone has emerged as a critical battleground where seller exhaustion is beginning to take shape. Much of the downward pressure stems from top buyers among short-term holders, who have been realizing heavy losses during the decline.

As Bitcoin tested $98K, the STH Realized Profit-Loss Ratio fell below 0.21, meaning over 80% of realized value came from coins sold at a loss. This intensity of capitulation briefly exceeded the last three major washouts of this cycle, underscoring how top-heavy the market has become and how pivotal the $100K level remains for near-term stability.

Fueling the Bounce Back

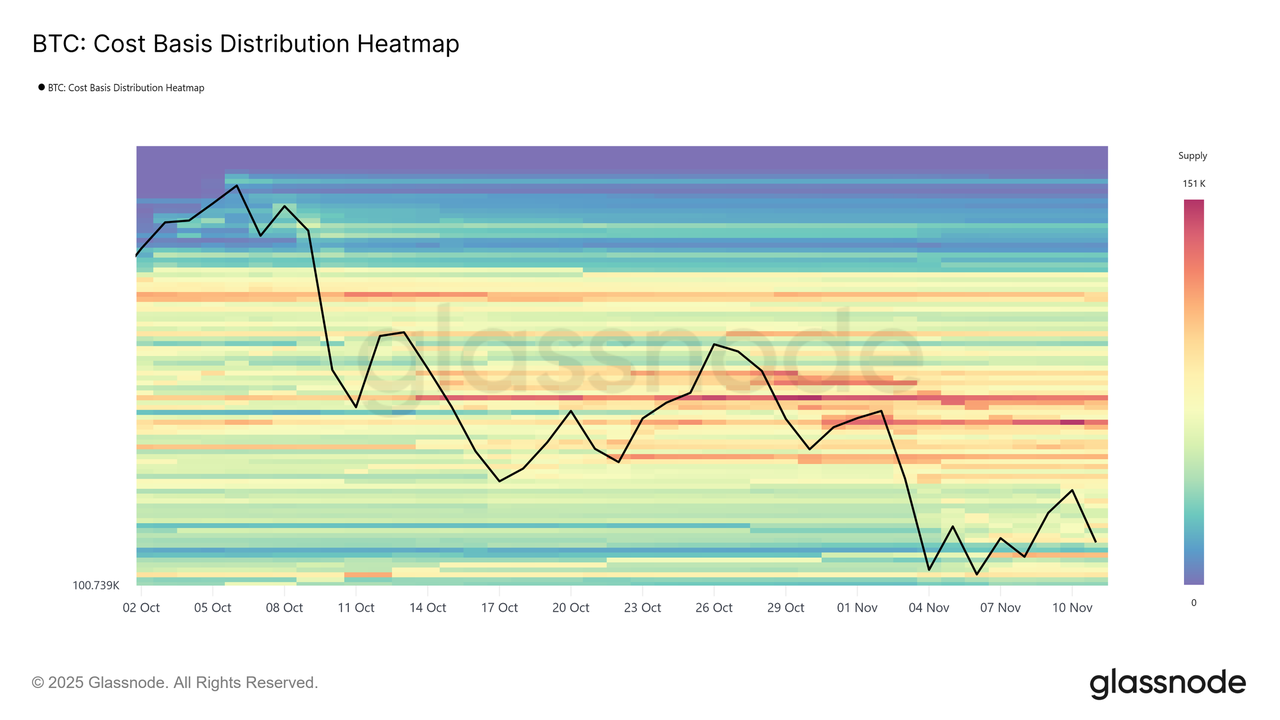

Turning to the demand side, the Cost Basis Distribution Heatmap reveals a clear buildup of realized supply around the sub-$100K zone, both before and after the rebound to $106K. The intensifying heat in this range signals renewed accumulation by buyers absorbing capitulation flows. This dynamic completes the picture; pairing seller exhaustion with steady accumulation, creating the foundation for a short-term recovery even within a broader bearish structure.

Conversely, a dense supply cluster between $106K and $118K continues to cap upward momentum, as many investors use this range to exit near breakeven. This overhang of latent supply creates a natural resistance zone where rallies may stall, suggesting that sustained recovery will require renewed inflows strong enough to absorb this wave of distribution.

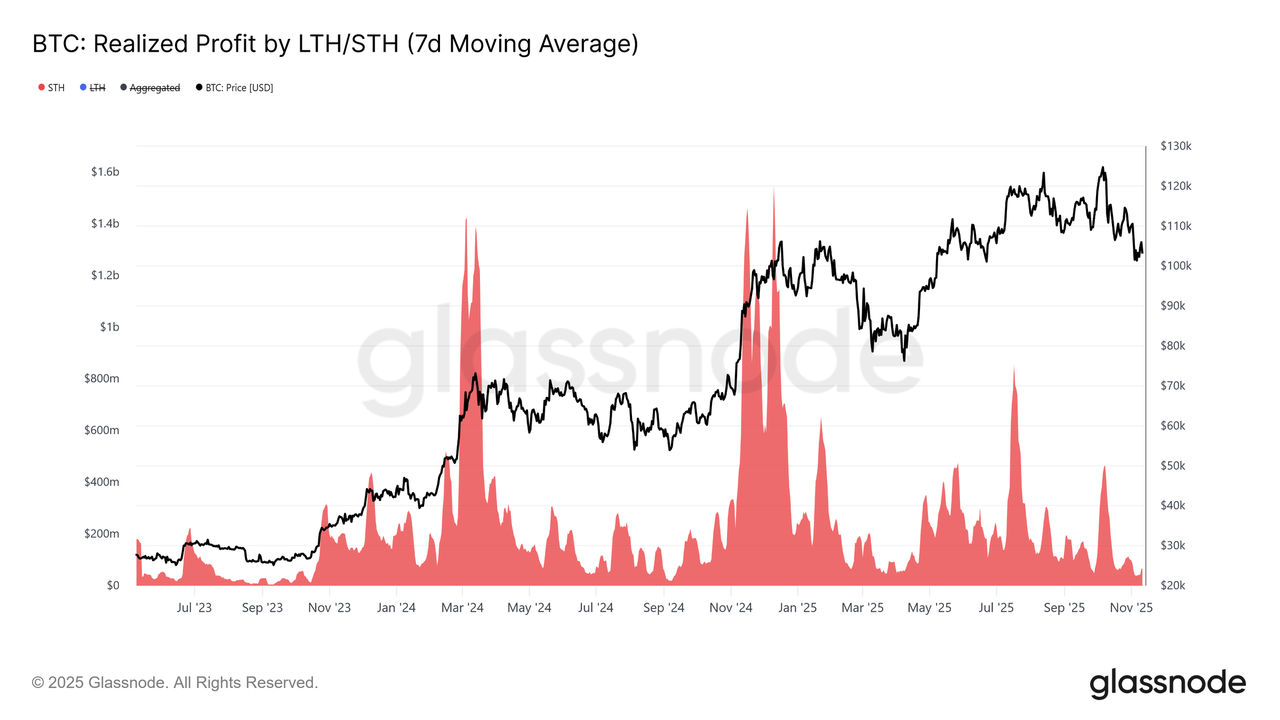

Demand Fades, Resistance Builds

The current market structure confirms a continuation of the downtrend that began in early October. A dense supply zone above $106K continues to exert sell pressure, and reclaiming the short-term holder cost basis (~$111.9K) remains a key prerequisite for any sustainable shift toward recovery.

On the demand side, the Realized Profit of Short-Term Holders (a proxy for new investor momentum) has been notably weak since June 2025, reflecting a lack of fresh inflows. For Bitcoin to push through the $106K–$118K top-buyer cluster, this metric must reverse higher, signalling renewed conviction and stronger demand from new market entrants.

Off-Chain Insights

ETF Outflows Resurface

Transitioning to the off-chain section, we first gauge the U.S. spot Bitcoin ETF markets. US spot Bitcoin ETFs have shifted to modest outflows in recent weeks, mirroring muted price action and waning momentum. After strong mid-year inflows, aggregate demand has flattened, suggesting a pause in institutional accumulation.

Historically, such neutral flow regimes align with market consolidation, where conviction rebuilds before the next directional move. A decisive return of inflows would signal renewed institutional confidence, while prolonged outflows could reinforce a more defensive market tone.

Leverage Dries Up

Bitcoin perpetual futures funding rates remain subdued across major exchanges, highlighting the lack of speculative appetite in derivatives markets. Since the leverage flush in October, both funding rates and open interest have drifted lower, signalling that traders are staying cautious with limited directional exposure.

This absence of aggressive positioning reflects a phase of market hesitation, often seen before volatility re-emerges. For now, the derivatives landscape remains quiet and balanced, leaning toward neutral sentiment rather than speculation-driven momentum.

Speculation Cools Broadly

Speculators’ reluctance to use leverage for directional bets extends beyond Bitcoin. Using our newly launched Multi-Asset Explorer, we can assess key futures indicators, funding rates and open interest across the top 100 digital assets.

The first heatmap shows a clear cooling in market-wide funding intensity since mid-year, interrupted only by brief spikes. This broad moderation suggests that traders have de-risked, with leverage and conviction subdued across both Bitcoin and altcoins. Overall, derivatives sentiment remains cautious, and liquidity continues to thin across the board.

Open interest trends across digital asset futures reveal a sharp decline in speculative engagement, most evident in altcoin markets. The heatmap shows a sustained dominance of blue tones, reflecting ongoing contraction in open interest and a clear absence of risk appetite.While Bitcoin maintains relatively stable positioning, leverage in altcoins has unwound to near cycle lows, with little sign of fresh capital rotation. This pattern underscores a defensive stance among traders, prioritizing capital preservation over speculation. In essence, altcoin derivatives activity has thinned materially—positioning remains light, conviction low, and market attention firmly centred on Bitcoin.

Conclusion

Bitcoin continues to trade within a mild bearish range, defined by strong resistance between $106K–$118K and key structural support near $97.5K–$100K. The market remains under the influence of top-heavy supply, with short-term holders still realizing losses. On-chain data highlighted a brief accumulation near $100K, suggesting localized support, yet without a decisive reclaim of the short-term holders’ cost basis (~$111.9), upside momentum is likely to stay constrained.

Off-chain indicators also echo this cautious tone. ETF outflows, muted funding rates, and low open interest point to subdued speculative engagement, while options traders continue to favor downside protection around the $100K line.

Overall, both on-chain and off-chain signals portray a market in a state of consolidation, stabilizing yet not yet ready to confirm a bullish reversal. Until renewed inflows or a clear macro catalyst emerge, Bitcoin appears bound to oscillate within this $97K–$111.9K corridor, with $100K remaining the psychological line of defence.

Cwallet: Your Gateway to a New Era of Crypto Finance

Cwallet, more than a wallet, is your all-in-one gateway to secure crypto management and dynamic trading.

In one powerful platform, you can store, swap, earn, and spend over 1,000+ cryptocurrencies across 60+ blockchains. Spend your digital assets like cash with the Cozy Card, while extra tools such as HR bulk management, mobile top-ups, and gift cards make every transaction smoother.

We're leveling up into a comprehensive financial hub — from zero-fee Memecoins and xStocks trading to fast, interactive price-prediction trades like Trend Trade and Market Battle, making crypto trading more accessible, engaging, and fun!

Join millions already reimagining what a crypto wallet can do. Stay cozy, trade smart, and embrace the future of Web3 finance.

Official Link

Official Site: https://cwallet.com

Twitter: https://twitter.com/CwalletOfficial

Disclaimer

This content is strictly for informational and educational purposes only. It does not constitute financial, investment, legal, or tax advice, nor is it an offer or solicitation to buy, sell, or hold any digital asset. Crypto assets involve high volatility and risks, and their value can fluctuate greatly. Readers must be aware of and adhere to the relevant local laws and regulations concerning digital assets in their specific jurisdiction, as product availability may vary. All investment decisions must be based on your own research (DYOR) and risk assessment. Some content herein may be generated or assisted by artificial intelligence (AI) tools. The author and platform assume no liability for investment losses.