Cryptocurrency Investment: Why and How to DYOR

DYOR is more than a recommendation; it is a basic requirement for digital currencies, where volatility, innovation, and regulatory upheavals are the norm.

Cryptocurrency investment represents a unique blend of technology and finance, offering exciting opportunities for investors but also posing significant challenges. Successfully navigating the crypto landscape demands a deep understanding beyond surface-level knowledge or following popular trends. It necessitates a thorough, well-informed approach to gaining additional knowledge and conducting extensive research.

No matter how new you are to cryptocurrency investing, you've probably heard the famous phrase "NFA DYOR," which stands for Not a Financial Advice, Do Your Own Research. This statement is commonly used by experts or crypto investors when predicting market trends and proposing a crypto asset with high return potential.

However, DYOR is more than a recommendation; it is a basic requirement for digital currencies, where volatility, innovation, and regulatory upheavals are the norm. DYOR enables investors to make informed decisions based on an in-depth understanding of the underlying technology, market dynamics, and the unique characteristics of each project.

In this post, we will look at the key elements of DYOR, covering everything from the fundamentals of blockchain technology and reading whitepapers to analyzing market trends, assessing security risks, and choosing the proper digital wallet. Let’s dive in!

Why Should You Do Your Own Research?

1. Volatility and Risks

Cryptocurrencies are well-known for their extreme volatility, which may result in large price variations over short intervals. This volatility is caused by various variables, including speculative trading, market sentiment, regulatory announcements, technical improvements, and macroeconomic trends. Investors must understand these market dynamics to navigate the associated risks and make informed decisions.

Crypto markets, unlike conventional markets, run around the clock, which might result in quick fluctuations outside of typical trading hours. Furthermore, compared to established assets such as equities or gold, many cryptocurrencies' price sensitivity is heightened by their relatively young and low market size.

2. Scams and Fraud

The bitcoin industry, while innovative, is not immune to scams and fraudulent schemes. The decentralized market and largely unregulated nature might attract rogue players who prey on unsuspecting investors. Ponzi schemes, phishing attacks, and fraudulent trades are all common types of scams.

To mitigate these dangers, investors should perform extensive research on the authenticity of projects and platforms. This includes checking project credentials, evaluating the transparency and track record of the project's team, and soliciting opinions from the community.

3. Regulatory Environment

The legal status of cryptocurrencies differs greatly among nations and jurisdictions, which influences investment choices. Regulatory positions might range from outright prohibitions and stringent controls to more crypto-friendly laws. These legal frameworks can influence taxation, trading legality, and the usage of cryptocurrencies as payment methods.

Keeping track of regulatory developments is critical since they can have a significant impact on market values and the sustainability of specific cryptocurrencies. For example, news of regulatory crackdowns frequently results in market declines, but positive regulations might increase investor confidence.

4. Technology Understanding

Understanding the technology that powers cryptocurrencies is crucial for determining their potential and long-term viability. The most essential technology is blockchain, a decentralized ledger that records transactions across several computers while maintaining security and transparency. Each cryptocurrency relies on its underlying technology and protocol, which can have a substantial impact on its performance, security, and use cases.

For example, Bitcoin's value stems from its security and pioneering position in the cryptocurrency sector, while Ethereum's smart contract capabilities have resulted in several decentralized applications. Understanding these technological foundations allows investors to more accurately assess the strengths, limitations, and prospects of various cryptocurrencies.

5. Diverse Market

The cryptocurrency market is diversified, with thousands of coins and tokens, each with its set of features, use cases, and technological bases. This diversity includes big cryptocurrencies like Bitcoin and Ethereum, as well as a variety of altcoins and tokens that serve specialized niches.

Thorough research helps in selecting cryptocurrencies with solid fundamentals, cutting-edge technology, and real-world applications. It entails examining aspects such as market demand, future adoption, developer activity, and community support. Given the continuously changing nature of the cryptocurrency space, staying up to date on developing trends and new initiatives is crucial.

How to DYOR in Cryptocurrency Investment:

1. Understand the Basics and Read Whitepapers

Understanding the principles of blockchain technology and cryptocurrency operations is the first step toward efficient DYOR implementation. This information is critical for comprehending the complexity of the cryptocurrency market and its possibilities. After you've gained a basic understanding, dig further by reading whitepapers for various crypto projects.

These documents are critical because they provide detailed information on the project's technology, use case, and roadmap. A well-written whitepaper can provide valuable insights into the project's viability and originality.

2. Check the Team’s Background and Security Aspects

The legitimacy and success of a cryptocurrency project depend on the people behind it. Researching the team members' histories, previous achievements, and blockchain technology knowledge can help paint a complete picture of the project's potential.

Along with the team, it is critical to review the project's security protocols. This covers how they protect assets and user data, and respond to possible cybersecurity attacks. A competent team combined with comprehensive security processes greatly reduces the investment risk.

3. Analyze Market Trends and Tokenomics

In the fast-paced world of cryptocurrencies, it is critical to stay current on market trends and news. Use tools like CoinMarketCap and CryptoCompare to analyze market behavior, price history, and sentiment.

Understanding a cryptocurrency's tokenomics is crucial in light of current market movements. This includes assessing the token's supply, distribution, and economic model. Look for projects with a clear and sustainable business strategy, since this might be a sign of long-term success.

4. Engage in Communities and Evaluate Use Cases

Participating in cryptocurrency forums and social media groups can bring helpful community opinions and perspectives. However, it is crucial to be skeptical and mindful of biased information. These forums also provide information on the real-world uses and prospective demand for various cryptocurrencies. Knowing how the cryptocurrency solves real-world problems and its prospective adoption rate are important considerations when evaluating the use case.

5. Regulatory Compliance and Diversification

Understanding the regulatory landscape is critical for cryptocurrency investing. Ensure that the project you're interested in meets all legal and regulatory criteria, as non-compliance might result in legal troubles and have an impact on your investment.

Again, diversity is critical in reducing risk in cryptocurrency investment. You can reduce the risks associated with the cryptocurrency market's volatility by diversifying your assets among many cryptocurrencies.

6. Choose the Right Crypto Wallet

DYOR also includes choosing the best crypto wallet for your cryptocurrency holdings. It's one thing to make an informed investment decision; it’s quite another to securely store your assets without getting hacked or losing your investment to cyber attacks.

Thus, part of DYOR is to investigate the wallet's security features, ease of usage, and support for the cryptocurrency you're interested in. The right wallet secures your assets and improves your entire investment experience.

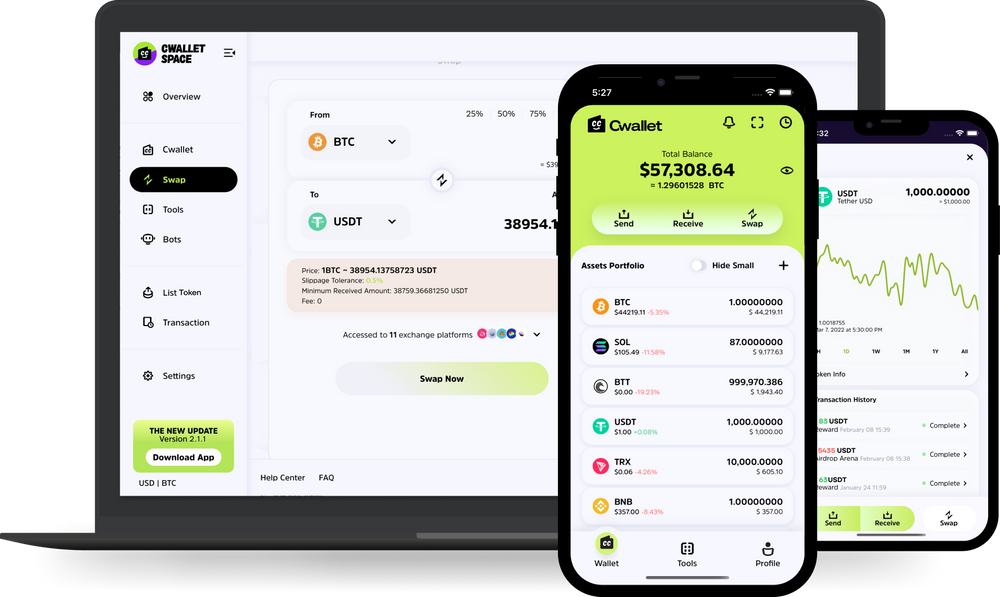

Cwallet is one such crypto wallet that ensures wallet security with advanced encryption to protect your cryptocurrency investment. Cwallet is a one-of-a-kind crypto wallet that combines custodial and non-custodial features, integrates on-chain and off-chain, and gives you the security, simplicity, and flexibility to manage and trade 900+ crypto assets in one spot.

Cwallet lets you quickly deposit, withdraw, and swap cryptocurrency at the lowest possible cost. It has the lowest transaction costs for cross-chain and "on-chain" swaps. As a result, you can freely swap these tokens within your wallet!

So, when you DYOR for cryptocurrencies, use Cwallet to secure your investment.

Get your free instant wallet now and start investing!

Conclusion

Understanding the technology, analyzing the project team, examining the market and economic model, communicating with the community, and considering regulatory and security considerations are all part of the DYOR process when investing in cryptocurrencies. This all-encompassing strategy reduces your risk and helps you to make educated decisions in the ever-changing world of cryptocurrency.

For More Beginner Tips, As Well As Detailed Guides On Cryptocurrency And Blockchain Technology, Do Well To Visit The Cwallet Blog And Follow Our Social Media Communities: