Comparative Analysis Between DeFi and CeFi Lending Platforms

In CeFi lending, stakers are ‘indirectly’ lending their funds to others. While you stake your funds on the centralized platform, the platforms are permitted to use your assets as they wish. This also includes lending. In CeFi lending, while the CeFi platform is the ‘lender’,

Cryptocurrencies and innovations related to them are experiencing immense growth. This trend is primarily driven by the widespread adoption of crypto in mainstream finance, which offers numerous benefits that transcend into the future.

Crypto lending represents one of these innovations, and similar to other concepts in blockchain technology, crypto lending platforms exist in either decentralized or centralized forms. These platforms differ significantly, impacting the nature of financing and transactions conducted on them.

This article makes a comparative analysis between DeFi and CeFi platforms, explaining the differences between them.

How Do DeFi Lending Platforms Work?

Just like the very nature of blockchain, decentralized lending platforms function without any central authorities. Parties to the loan (the lender and the borrower) deal with each other directly. Decentralization ensures that transactions are conducted directly between participants, without the need for a central authority.

Smart contracts, the foundation of DeFi lending, enable parties to enter into a lending pool, pooling their crypto assets together for borrowers to lend. Investors holding crypto assets may opt to use a DeFi lending pool rather than letting their assets remain idle. They commit their funds to the lending pool to earn a specific APY (Annual Percentage Yield). At the end of the year, or at any time they choose to recall their investments, they will gain yield for lending their crypto assets.

On the other hand, borrowers, who need crypto assets to diversify and make profits without having to touch their presently owned assets can use their present assets as collateral to obtain a loan from the DeFi lending pool.

Factors like the Loan-To-Value (LTV) can affect the amount of loan a borrower can obtain from the lending pool. For example, if the LTV is 50% and a borrower has 1 BTC as collateral, the borrower can only loan 0.5 BTC. The interest that borrowers pay on the loan received accrue to lenders as yield after contributing to the lending pool.

How Do CeFi Lending Platforms Work?

CeFi lending platforms benefit from institutional backing, as they are often operated by established financial institutions or banks with a long-standing reputation for reliability and trustworthiness. CeFi lending platforms operate mainly on a financing practice in cryptocurrency known as ‘staking’.

Staking requires that asset owners lock up their assets for a period of time to earn rewards, which are usually a percentage of the amount staked.

In CeFi lending, stakers are ‘indirectly’ lending their funds to others. While you stake your funds on the centralized platform, the platforms are permitted to use your assets as they wish. This also includes lending. In CeFi lending, while the CeFi platform is the ‘lender’, they mostly do not own the funds lent out.

However, they set the terms of the loan, such as the Annual Percentage Rate (APR), the duration of the loan, and the loan-to-value ratio, which determines the amount that a borrower can borrow based on the value of his collateral.

DeFI Lending Platforms vs CeFI Lending Platforms

Cwallet:Your Ideal Crypto Lending Platform

Cwallet is a one-stop crypto platform that combines the generic services of a crypto wallet with other important services, like a lending platform.

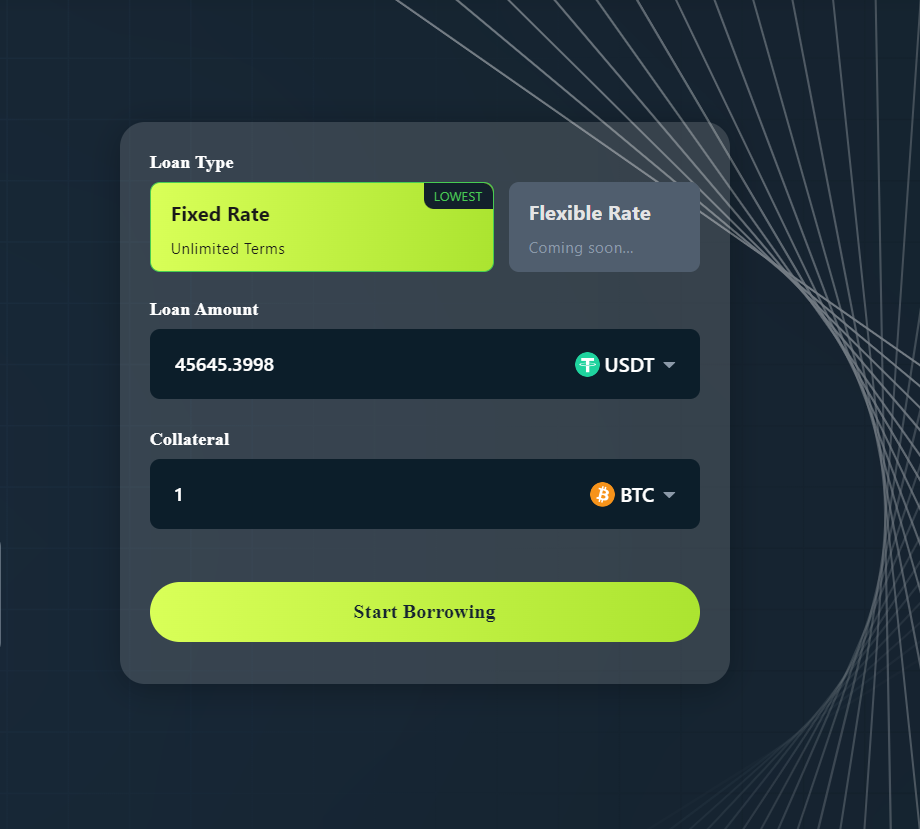

Cwallet supports lending in multiple cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), and Tether (USDT), allowing you to use 10+ common cryptocurrencies as your collateral, while enjoying a whopping 65% LTV ratio.

At a fixed annual percentage rate (APR) of 13%, Cwallet offers the most competitive interest rates for borrowing in the market. The APR is estimated based on the hourly value, so you can decide to repay your loan amount at any time.

Cwallet loans exist indefinitely without any borrowing term and, as such, do not become overdue.

Final Thoughts

While both DeFi and CeFi lending platforms offer unique advantages and face distinct challenges, crypto enthusiasts seek a blend of security, accessibility, and regulatory compliance.

Cwallet serves as a secure crypto wallet and offers lending opportunities within a user-friendly interface. Cwallet offers consumers a reliable means to store and manage their digital assets thanks to backing from institutions, open operations, and a dedication to regulatory compliance.

Embrace the future of cryptocurrency with Cwallet and unlock the full potential of crypto lending .