Can I Pay My Remote Employees in Cryptocurrency?

Work-from-home became a standard practice due to Covid-19, & several companies saw the need and the cost it would save them without making their employees appear in a physical location. Several factors are always considered when paying remote workers, including their location, payment method, and..

Over the last two years, the world of employment has seen a significant shift from a physical working environment to a complete hybrid of remote working experiences, giving rise to the work-from-home model. Work-from-home became a standard practice due to the Covid-19 pandemic, and several companies saw the need and the cost it would save them without making their employees appear in a physical location.

Working remotely benefits both employers and employees because it gives people a better work-life balance and a feeling of independence and reduces stress levels significantly. In addition, remote employees are reportedly more productive because it allows them to do their jobs efficiently.

However, working remotely and transiting from the conventional employment structure have some drawbacks for employers.

Firstly, the remote hiring process is complicated due to regional differences in recruitment requirements and qualifications. But the real difficulty arises when it comes to employees' remuneration. This can be complex and time-consuming because most remote workers are spread across several countries. As a result, the issue of timely payment due to different time zones and the appropriate currency that equates to the employee's currency value arises.

So, how do you pay your remote employees? How do you manage and balance the varying currency exchange of your employees in different regions?

The Traditional Payroll System

As an employer, setting up a payroll system for remote employees could be a complex quest for you or your HR department. Firstly, obtaining international payroll rights takes significant time and resources. Then, for each nation or region where your remote employees are located, you must set up a compliant payroll system that considers the local paydays, contributions, taxes, and regulations. This is a lot of work for you, who could face legal repercussions if not properly executed.

Unfortunately, even when you have the payroll system set up, your HR has a lot to deal with while paying each employee for their service at the end of the month. For instance, imagine making payments to employees with different modes of receiving international funds. This means the HR department will have to manually sort different transfer modes for every employee, which is time-consuming. In addition, delays are inevitable for employees to get their salaries, which could take 1-3 business days to reflect. Also, the cost incurred for these payment methods due to currency and exchange rates of employees is always at your loss and to the organization's detriment, which is not suitable for your finances.

Ideally, sending your employee's salary through this method takes some time, and some payment methods are peculiar to a region. Moreover, you will need a third-party payment platform to send wages to your employees.

Other Ways To Send Salary?

Several factors are always considered when paying remote workers, including their location, payment method, and exchange rate. However, the location of your employee takes the most significant consideration as some payment methods are peculiar to the region.

So, there are several online payment methods that you can use to pay your employees, but these are pretty popular within the remote entrepreneurship space;

PayPal

Payal is the most widely used payment platform in the industry. Paypal is accepted in almost every country and accepts multiple currencies. To pay remote employees in any country, a credit card or a bank account can be linked to the platform. On the other hand, Paypal charges the recipient a percentage of the transaction value as a transaction fee for receiving payment. Furthermore, employees lose more money due to the exchange rate because Paypal offers a lower exchange rate than local banks. This means that the employer pays more to cover the charges incurred, or the employee is paid less than their ideal salary.

Payoneer

Payoneer is another virtual payment platform employers use to pay salaries to remote employees. It also supports multiple currencies and is accepted in several countries. However, Payoneer is costly; there are charges for withdrawals, deposits, and other transaction forms. In addition, the exchange rate offered is relatively low compared to the currency value and slow exchange processing. Transactions can take days to complete, and this is detrimental to the organization's growth as the employee's productivity will decrease without getting paid in due time.

TransferWise

Transferwise is a multi-currency payment platform that specializes in international transfers. Transferwise, unlike PayPal and Payoneer, charges lower fees when paying remote workers. Its main advantage is its low transaction fee and close conversion rate to the market rate. However, to set up an account, employers must undergo a verification process, which is unavailable in most countries. As a result, employers face the challenge of hiring employees who do not live in such a region.

Even though these payment methods bridge the payment gap between you and the employees, you will incur many costs if you have many remote employees.

The Easy Solution To Pay Salary To Your Employee

However, you can use the rapidly growing cryptocurrency and blockchain technology to create a borderless payroll system without restriction to combat the challenges the conventional payroll system faces.

In addition, you don't worry about obtaining the legal right to set up due to its decentralized nature, thereby avoiding the technicality and difficulty associated with the conventional payroll system.

Crypto Payroll System

The crypto payroll system works similarly to the conventional payroll system, promoting transactions between employers and employees. However, a crypto payroll system conducts transactions between the two parties without any intermediary, and these transactions are secure, instant, and without border restrictions.

These crypto payments are executed within minutes, instead of a conventional payroll system taking 1-3 business days.

Furthermore, the crypto payroll system is built on blockchain technology and offers immutability of records and transparency in the transactions between employers and employees.

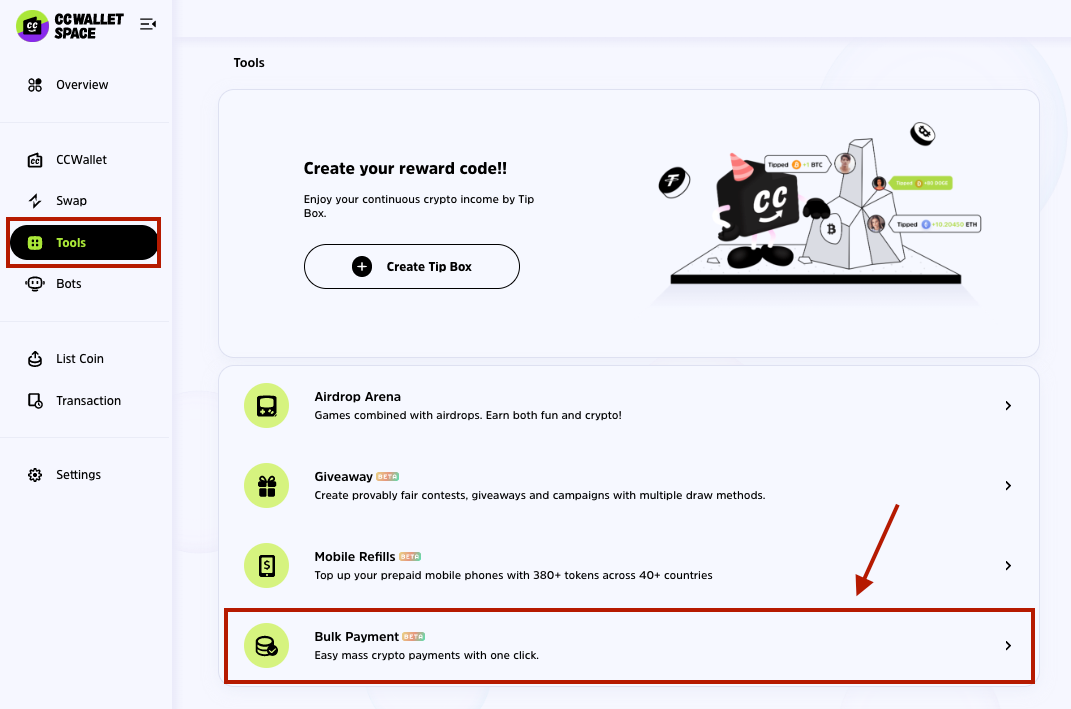

Paying Remote Employees With Cwallet Bulk Payment

Before using the crypto payroll system, both employer and employee must have a crypto wallet. The employer will use this wallet to send payments, and the employee will receive and store payment tokens.

With Cwallet, you can easily and quickly pay remote employees seamlessly anywhere in the world using the Cwallet Bulk Payment Tool. All you have to do is choose the crypto asset of your choice, approve the transaction, and immediately pay all your remote employees without delay.

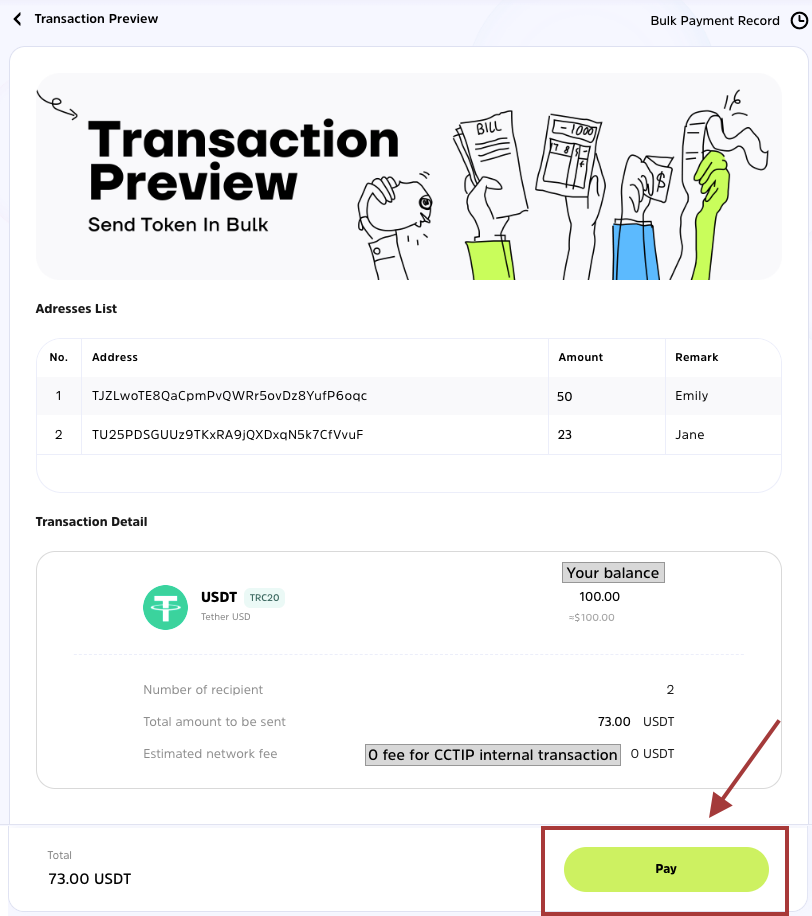

Once you have the spreadsheet of your employees, which carries their payment wallet address, crypto amount, the month being paid for, and other information, you then upload the spreadsheet, usually a .CSV file, and select the network and cryptocurrency for the bulk payment.

Cwallet Bulk Payment Tool will automatically check for any formatting error in the uploaded file and inform you of the line where the error is spotted. Once all corrections and verification have been made, the system will advance to the payment portal, where all the information will be displayed for review.

Finally, the bulk payment will be deducted from the current Cwallet account once you have reviewed your order and confirmed all information to be accurate. You can check the details of your bulk payment and the delivery status for each employee.

Why Cwallet For Bulk Employee Payment?

Cwallet Bulk Payment Tool allows employers to send payments in custom amounts to multiple wallet addresses simultaneously with just one action. The bulk payment feature benefits the employer and the employee by executing transactions securely and on time. Some of the other benefits are;

Cross-border Payment

There is no restriction to where payment can be sent. As the employees work remotely, they do not need to worry about how to get paid in their local currency. As such, employers can seamlessly make payments to different employees across various regions.

Automated Payment

Payments do not require manual input, as the system automatically checks for errors and automates the process. This helps employers save costs by employing more hands in the HR department.

Instant Transaction

Cryptocurrency transactions are settled at a quick pace. However, regardless of the employee's location, the payment is received immediately, without waiting 1-3 business days.

Zero Transaction Fee

This is the most important advantage of using the bulk payment feature. Employers are not required to pay a transaction fee for each employee payment, and employees are not charged for deposits and withdrawals from their wallets.

Investment Opportunity

Cryptocurrency has proven to be profitable; both employers and employees can profit from price movements and increase the value of their assets.

The Takeaway

Of course, the world is shifting to adopting the uniqueness of cryptocurrency and blockchain technology. Now employers prefer using crypto to pay salaries rather than fiat currency. You should do that too because it is easy, convenient, and secure.

Interestingly, using the Cwallet bulk payment feature is FREE! You do not need to pay a third-party app to handle your payroll. Regardless of the size of your organization, Cwallet will handle your multi-payment system seamlessly with ZERO fees.

Cwallet Is A Unique Cryptocurrency Wallet That Combines Custodial And Non-Custodial Features. It Provides Solutions To the Crypto Needs Of Individuals Or Businesses Through Various Tools.

Download Cwallet NOW and start paying your remote employees seamlessly.

What's more?

Cwallet does not charge any deposits, withdrawals, and token swap fees. Therefore, using Cwallet is absolutely FREE!

So, what are you waiting for?

Download Cwallet NOW!