Bear Season Not Over Yet - Is The Crypto Market In A Bull Trap?

This shows that the last rally is nothing but a bull trap that will be accompanied by a market correction. In our analysis two weeks ago, we mentioned that it may be too early to call an end to the bear market, and advised that it would be better to wait it out and observe.

After spending the year so far in a red market, crypto investors can no longer wait to see the market soar again. Thankfully, after Bitcoin set a 553-day low of $17,622, it started to rally upwards, gaining over 40% to move above $25,000 in 59 days; the highest upward rally since the 63-day rally from January – March that saw Bitcoin gain 46%. However, given that the two-month rally in the 2022 Q1 led to a further plunge, investors and enthusiasts are wondering if this is another bull trap or if the bear season is ending soon.

What is A Bull Trap?

A bull trap occurs when a crypto asset experiences a brief upward rally after a huge decline in value, only to plunge again and “trap” investors who bought the asset in the hope of a revived bull market.

The opposite of a Bull Trap is a Bear trap, which happens in the exact opposite direction, when a seemingly overvalued asset starts to lose value, attracting short traders, only to soar higher up and liquidate them.

Are We in A Bull Trap?

The typical bear market lasts for 9 months on average; hence, since the current bear market entered its ninth month in August, several investors have anticipated a trend reversal to see the beginning of a new market cycle. As a result, the 59-day rally that saw Bitcoin move from under $18k to over $25k was seen as the beginning of a new market cycle, and the bear season was indeed over. However, is the bear market over, or is this just a bull trap?

Since hitting $25k, Bitcoin’s price has fallen by 18%, currently in the $20k region, and while some investors may see this as a correction, it is more probable that we are in a bull trap; however, we cannot assertively conclude without getting analytical insights; hence, we will investigate Bitcoin’s demand.

Evaluating Bitcoin’s Demand

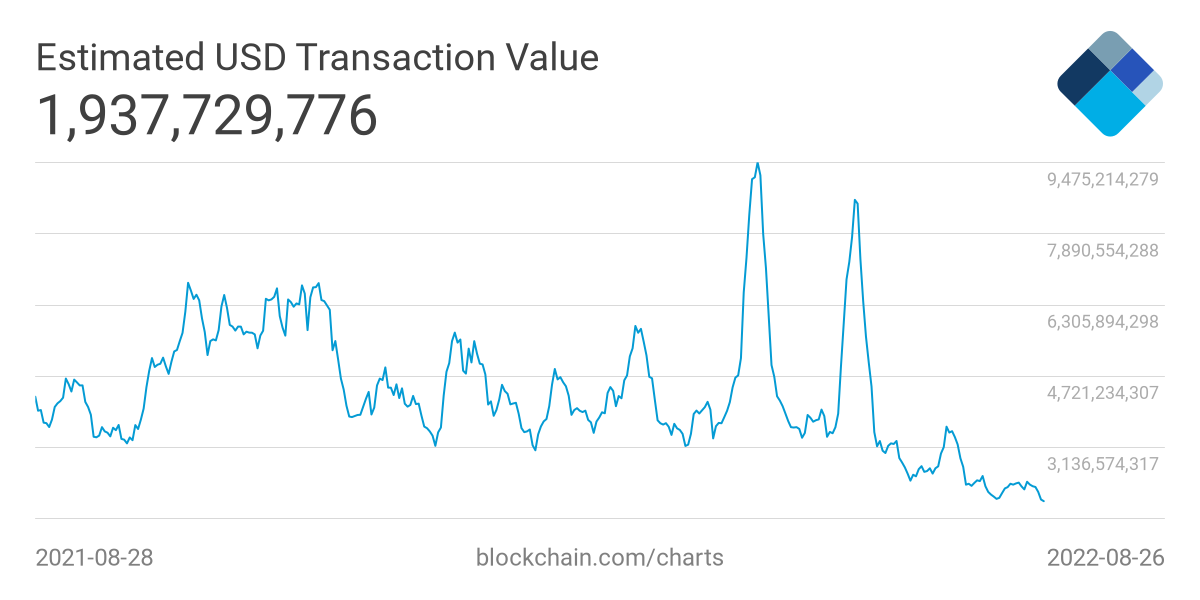

According to data from blockchain.com, The current transaction value is $1.94 billion (over the past 7 days), which is the lowest in the last 365 days. In comparison, the peak average transaction rate is $9.48 billion, giving a mid-range of $5.7 billion; hence, judging from this data, it is safe to say that blockchain transactions have plummeted, and this low activity is against the sentiments of a bull run.

Similarly, transaction fees has greatly plummeted, on a free fall from last year. The total average transaction fees for the past 7 days is just over $226k; however, this figure was over $1 million within the past 365 days. High transaction fees signify network congestion; hence, the steady decreasing transaction fees, show the reluctance of network participants to trade Bitcoin.

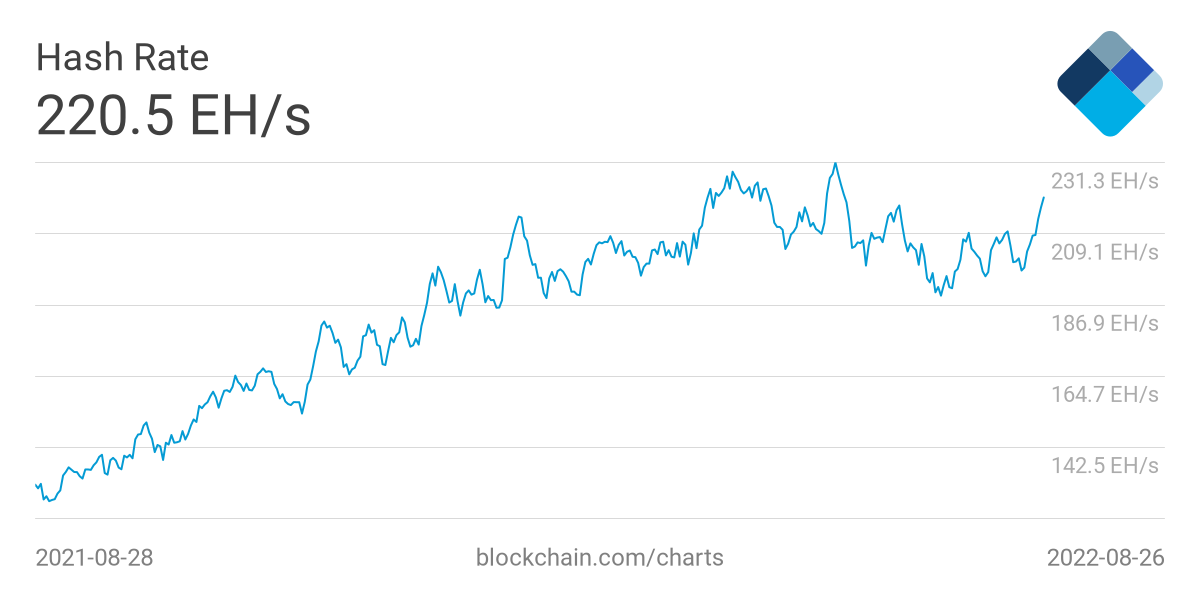

The Blockchain's Hash Rate tells us how fast miners can produce new blocks. A steadily increasing Hash Rate signifies a low market activity; hence, in the absence of congestion, transactions are completed more speedily.

The data above and many more signify the steady reducing market activity, despite the 2-month rally from June to August; hence, it is obvious that the upward market moves were stimulated by a smaller percentage of the blockchain network participants, which is not enough to trigger market sentiments towards a sustained bull run.

This shows that the last rally is nothing but a bull trap that will be accompanied by a market correction. In our analysis two weeks ago, we mentioned that it may be too early to call an end to the bear market, and advised that it would be better to wait it out and observe.

How Long Should Investors Wait? When Will The Bear Season Be Over?

Judging from the poor market activity, it may appear as though the bear market will linger for much longer. However, it's not only demand that has waned; selling pressure is also very low. Hence, we may be entering longer periods of accumulation, until the market sees a huge trigger that can drive a huge bullish sentiment.

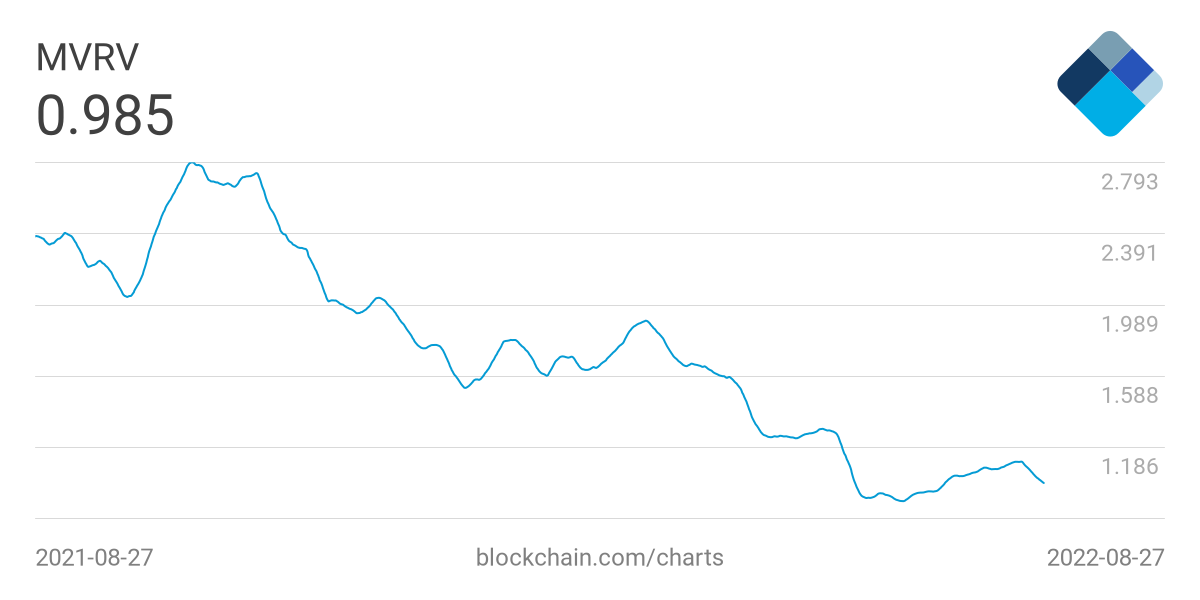

Judging from the MVRV, we can see that selling pressure is at a minimum. Typically, MVRV values below 1 signify grossly undervalued assets, where selling pressure will be near exhausted; while MVRV values above 3.5 signifies overvalued assets where buying pressure may be saturated.

MVRV values within the last two months have ranged between 0.88 and 1.1; hence, this shows us that the end of the bear market is imminent; however, one big push is needed to change the market narrative and begin a new cycle.

Final Takeaway

Waiting out the bear market can be somewhat frustrating for investors; as a result, many try to be ahead of the curve and time their entry to the new bull run. Unfortunately, many investors fall into bull traps and lose some parts of their investments.

Proactiveness in the market could assure maximum profits; however, patience is important when looking to begin a new market cycle, because many factors are at play.

For more beginner tips, as well as detailed guides on cryptocurrency and blockchain technology, do well to visit the Cwallet Blog and follow our social media communities:

Twitter, Telegram, Reddit, Discord.