$20 Billion Liquidation in 24 Hours, What's Happening in the Crypto Market?

U.S. President Trump announced a 100% additional tariff on China, causing a sharp decline in crypto asset prices.

Key Takeaways:

- U.S. President Trump announced a 100% additional tariff on China, causing a sharp decline in crypto asset prices.

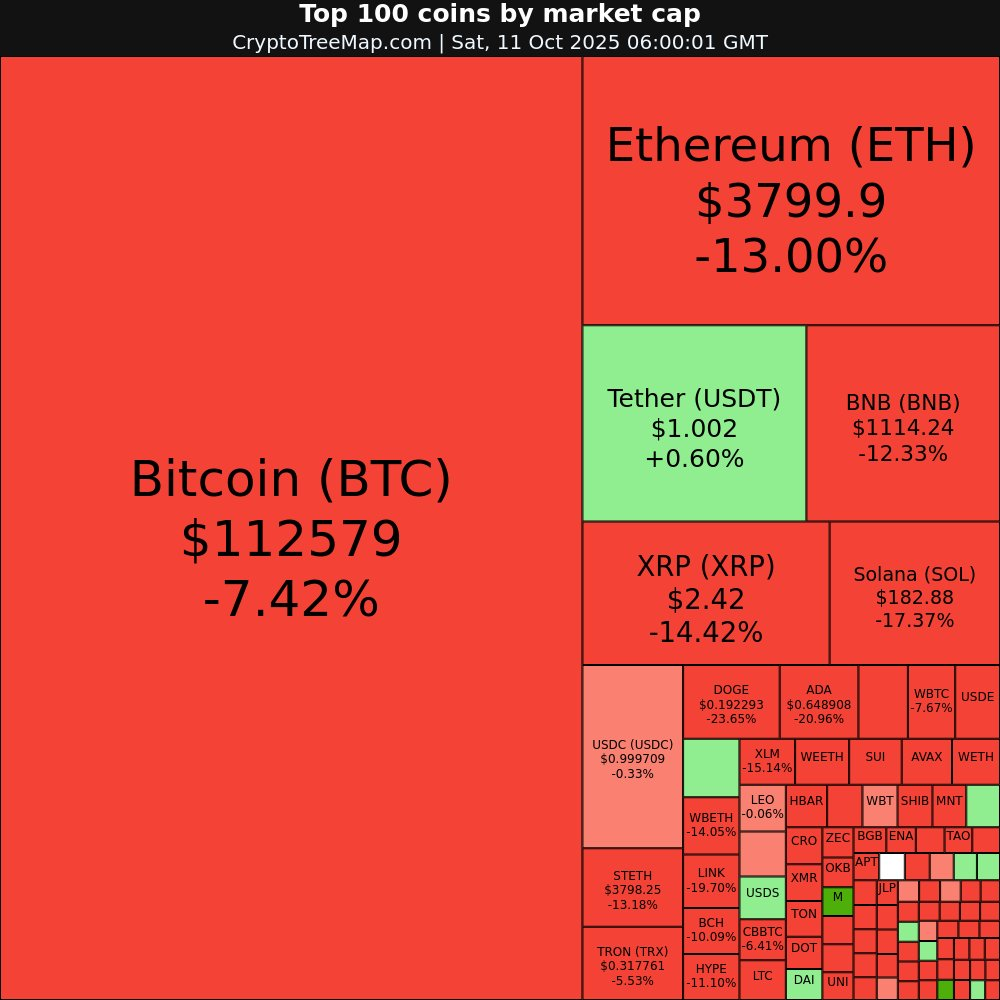

- Bitcoin fell below $110,000, tumbling over 10% in 24 hours, while ETH, XRP and SOL saw prices crashing 15%-30%.

- The massive liquidation was structurally amplified by widespread exchange outages and market maker failure, exposing the fragility of central infrastructure.

- The systemic failure of key instruments like the USDe stablecoin confirmed the market’s vulnerability to internal structural flaws and shattered investor confidence.

The early hours of October 11th delivered an extreme shockwave across all asset classes. The crypto sphere was hit hardest, with Bitcoin briefly cracking the $110,000 support level and Ethereum suffering a stunning 17%+ decline. The fallout was swift: $20 billion in leveraged positions were wiped out in 24 hours, triggering margin calls for over 1.65 million traders network-wide.

The panic wasn't confined to digital assets. Major US stock indices registered their worst session in a month, crude oil plummeted to a five-month low, and the Dollar Index (DXY) saw a sharp 0.7% drop. Only gold provided refuge, with New York futures rallying nearly 1.7%, confirming the market's aggressive flight to safety.

What forces triggered this synchronized crash across crypto, stocks, and oil? Is there any momentum left for a rebound, and when can we expect relief? We dive into the driving factors and the outlook for recovery.

What Caused the Market Flash Crash? The Multi-Factor Cascade

The $20 billion catastrophe was driven by a perfect storm of four factors, where external political shock amplified internal structural weaknesses into a full-scale systemic crisis.

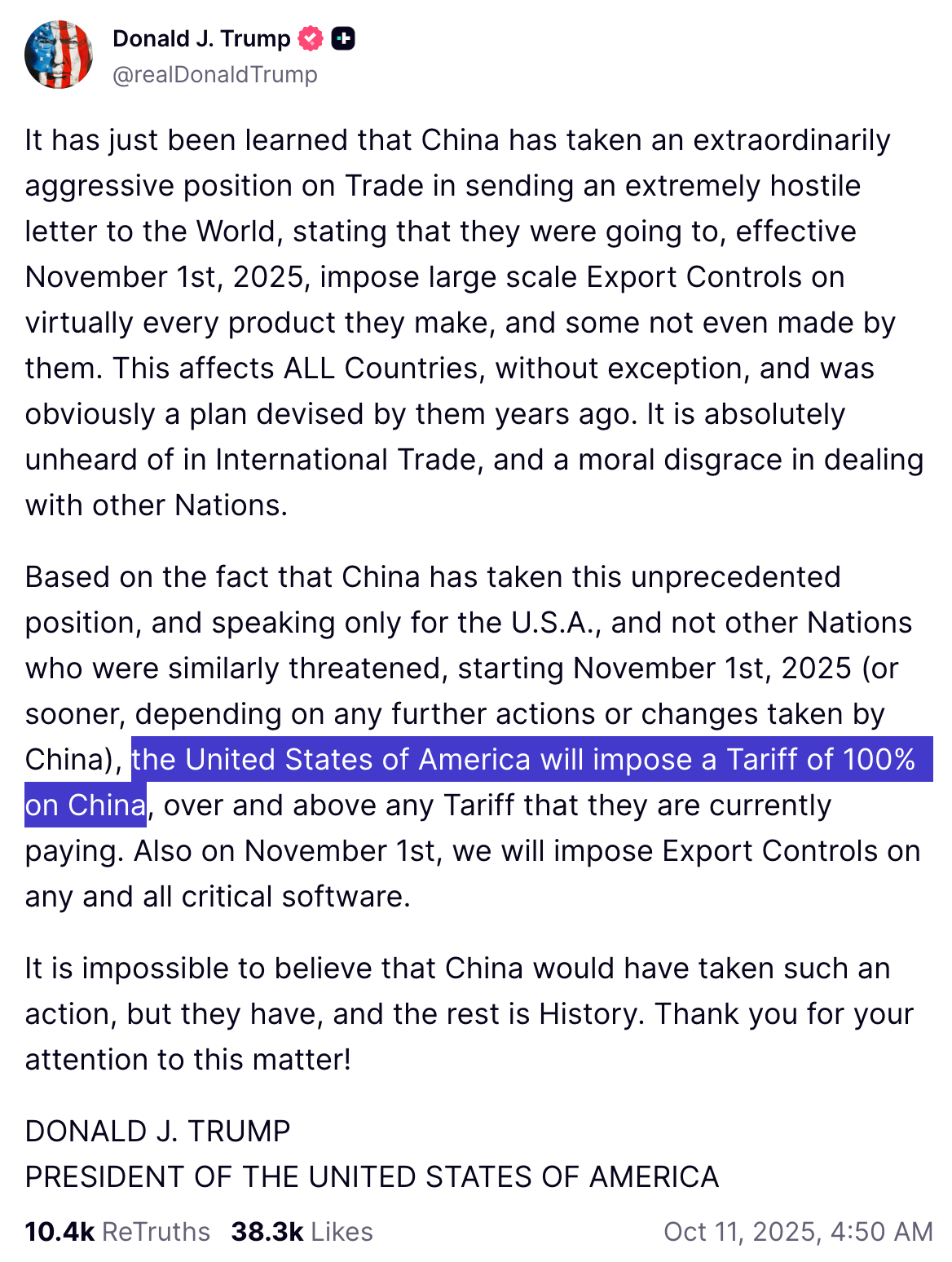

The Geopolitical Spark: Trump's 100% Tariff

The chain reaction began with the sudden escalation of trade tensions. In the early hours of October 11th, Trump's announcement of an additional 100% tariff on Chinese goods instantly fractured market confidence. This was the external trigger that flipped global capital into a "risk-off" stance.

This systemic selling hit U.S. stocks, oil, and cryptocurrencies simultaneously, proving that the market was reacting to a major threat that far exceeded crypto's own internal dynamics.

Infrastructure Breakdown Accelerates Panic

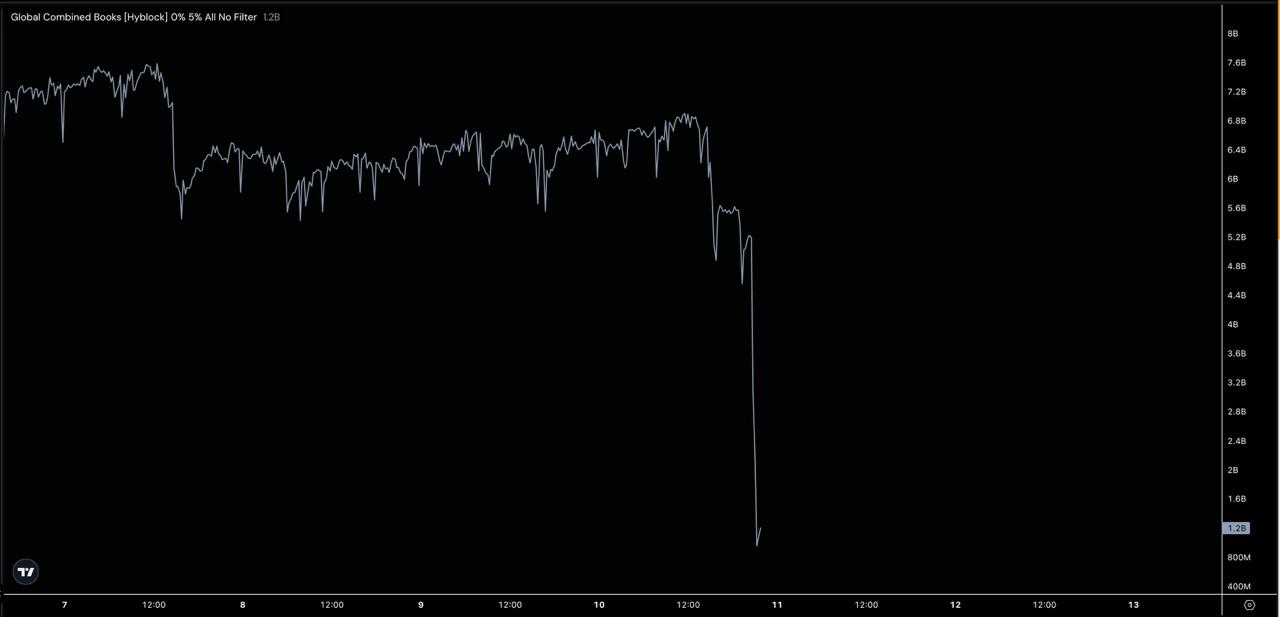

The first major INTERNAL driver was the complete failure of the core trading infrastructure. In the critical moments of the price collapse, the sheer volume of trading overwhelmed centralized exchanges.

- Exchange Overload: Major exchanges, including Binance, Coinbase, and Kraken, reported significant delays, congestion, or full outages.

- Locked Liquidity: This infrastructure failure was catastrophic: it effectively locked millions of users out of their accounts, preventing them from posting collateral or executing urgent stop-loss orders. The inability to transact turned a sharp market dip into a full-blown flash crash and accelerated the investor panic.

The Systemic Crisis: Depegging and Liquidation

The ultimate financial trigger was a deadly combination of structural leverage and systemic asset failure.

- Excessive Leverage: The market entered the sell-off with dangerously high leverage. The initial geopolitical drop automatically triggered a massive liquidation cascade (over $19 billion), where forced selling by exchanges further depressed the price.

- Depegging Events: The deepest blow to investor confidence came from the failure of key token mechanisms. Reports of the synthetic stablecoin USDe depegging significantly (dropping to $0.6567) and sharp drops in wrapped tokens (WBTC, WBETH) on major exchanges caused critical forced liquidations and a profound loss of trust in the system's stability.

The Amplification Effect: Whales and Volatility

In the illiquid environment, the actions of large contract traders served as the final amplifier.On-chain data confirmed that contract whales were highly active, strategically opening short positions before the collapse and taking massive profits at the bottom of the dip. Conversely, other high-profile long whale accounts were forcibly wiped out. This dual action—strategic profit-taking and massive liquidation—injected multiple rounds of dollar value into the sell pressure, confirming that excessive leverage was rampant on both sides of the market.

Market Consensus: Bullish Long-Term Conviction Amidst Short-Term Chaos

Following the sharp sell-off, the market's response is highly polarized, but institutional long-term conviction remains surprisingly intact. The prevailing view among major financial players is that the recent drop is a temporary setback in a secular bull market, driven by powerful structural tailwinds.

The Structural Bull Case: Institutions and Liquidity

The most potent arguments for a strong recovery are based on liquidity flows and institutional acceptance:

1. Bitwise CIO:

The head of the investment firm argues that all favorable factors are aligning for a final leg up, predicting new all-time highs for BTC in Q4. This confidence is rooted in three key pillars:

- The industry has won over major wealth management platforms (Morgan Stanley, Wells Fargo), which control trillions in assets and now allow client exposure to crypto.

- The “debasement trade”—investing against currency devaluation—is a major focus on Wall Street, and governments are clearly pursuing inflationary policies.

- Higher prices are expected to create a self-fulfilling prophecy, stimulating greater demand for Bitcoin ETFs.

2. State Street:

The custody giant projects that by 2028, the majority of institutions will have doubled their holdings of Bitcoin and other crypto assets. This confirms that the long-term trend of institutional adoption is structural and ongoing, regardless of short-term volatility.

The Foundational Faith: Bitcoin and Ethereum

Market leaders are reinforcing their belief in the foundational assets, viewing the technology as an inevitable force:

1. Changpeng Zhao (CZ)

The Binance founder states that access to Bitcoin is a "gift of the era," reaffirming his belief that Bitcoin is the undisputed "dragon head" of the industry, unchallenged as the core future technology.

2. Michael SaylorThe prominent Bitcoin strategist succinctly dismissed the geopolitical panic, asserting the asset's independence from political tools like tariffs: "Bitcoin has no tariffs."

The Ethereum Yield and Global Strategy

The positive outlook extends to Ethereum, where new developments are expected to cement its role as a high-yield asset:

1. ABCDE Co-Founder Du Jun

Highlights that the impending staking feature for U.S. Spot Ethereum ETFs is a massive catalyst. By adding a "yield attribute" similar to a stock dividend, this feature is expected to attract billions in new institutional and retail capital that would otherwise be dormant.

2. Deutsche Bank Report:

The bank's analysis suggests that by 2030, both Bitcoin and Gold will become significant components of central bank reserves. The report views the current geopolitical uncertainty (like the U.S. tariff policy) as a necessary push for investors to seek inflation hedges and digital safe havens.In short, the consensus suggests the fundamental bull market is intact, driven by institutional flows that view this dip as a temporary disruption caused by external political noise.

When Will the Bull Run Resume?

The consensus is that the fundamental bull market is not over. However, for the strong institutional tailwind (ETF inflows, the Ethereum ETF staking feature) to fully resume, the market must first see the political risk subside and the internal liquidity failures resolved. Until then, stability remains fragile, but the powerful forces driving the long-term upward trajectory are waiting in the wings.

Cwallet: Your Gateway to a New Era of Crypto Finance

Cwallet, more than a wallet, is your all-in-one gateway to secure crypto management and dynamic trading.In one powerful platform, you can store, swap, earn, and spend over 1,000+ cryptocurrencies across 60+ blockchains. Spend your digital assets like cash with the Cozy Card, while extra tools such as HR bulk management, mobile top-ups, and gift cards make every transaction smoother.

We're leveling up into a comprehensive financial hub — from zero-fee Memecoins and xStocks trading to fast, interactive price-prediction trades like Trend Trade and Market Battle, making crypto trading more accessible, engaging, and fun!

Join millions already reimagining what a crypto wallet can do. Stay cozy, trade smart, and embrace the future of Web3 finance.

Official Link

Official Site: https://cwallet.com

Twitter: https://twitter.com/CwalletOfficial

Disclaimer: The content is for informational purposes only and is not investment advice. Please invest wisely and at your own risk.