What Does Bitcoin Dominance Tell You About The Crypto Market?

If the BTC dominance index and Bitcoin's price are in an uptrend, buy bitcoin. If the BTC dominance index is in an uptrend, but Bitcoin's price is in a downtrend, sell altcoins. If the BTC dominance index is in a downtrend, but Bitcoin's price is in an uptrend, buy altcoins.

Due to the volatile nature of the crypto market, investors, traders, and market participants all look for trends and patterns that can get them ahead of others in the market to influence their trading decisions and make profits. As a result, some investors monitor the "Bitcoin Dominance Index," which gives an insight into the market share of Bitcoin compared to tens of thousands of other cryptocurrencies (altcoins) and how this relationship can influence investment decisions.

When analyzed correctly, the Bitcoin Dominance Index can aid investment decisions for Bitcoin and Altcoins alike. In this article, we'll dissect the intricacies of Bitcoin Dominance and its relation to investment decisions and strategies.

What Is Bitcoin Dominance?

Bitcoin dominance Is the ratio Of Bitcoin's market capitalization to the market capitalization of the entire crypto market. As the first crypto to exist, Bitcoin's dominance started at 100% and gradually reduced with the presence of Altcoins; however, despite the increasing number of altcoins, Bitcoin's market capitalization isn't always reducing. When Bitcoin records higher dollar investments in comparison to altcoins, its overall value increases, regardless of whether altcoins have increased in number or not.

To understand this concept clearly, the knowledge of crypto market capitalization (market cap) is important.

What Is Market Capitalization?

The Market Capitalization of a specific cryptocurrency refers to the dollar worth of its overall market value. It is calculated by multiplying the number of coins/tokens in circulation by the unit price.

Hence, to calculate Bitcoin's current market cap, we can compute it as:

Bitcoin Unit Price × Bitcoin Circulating Supply

= $19,100 × 19,115,868

= $365,113,078,800

The market cap for any cryptocurrency can be calculated similarly, as described above.

Generally, the market capitalization of any asset gives an insight into its value; hence, it can help you judge whether it is overvalued or undervalued by comparing its real-life utility and value to its worth. For example, if an asset is extremely valuable but has a low market capitalization, then buying it early would fetch you huge profits in the long run. However, if the asset is overvalued, investing in it may cause losses, as you would be a latecomer to the party, and the asset may go downwards from its peak before you are able to make reasonable profits.

What Is The Relationship Between Bitcoin Dominance and Market Capitalization?

As mentioned earlier, Bitcoin dominance is the ratio of Bitcoin's market capitalization to the market cap of the entire market. Hence, Bitcoin dominance can be computed as

Bitcoin dominance = Bitcoin market cap ÷Total cryptocurrency market cap

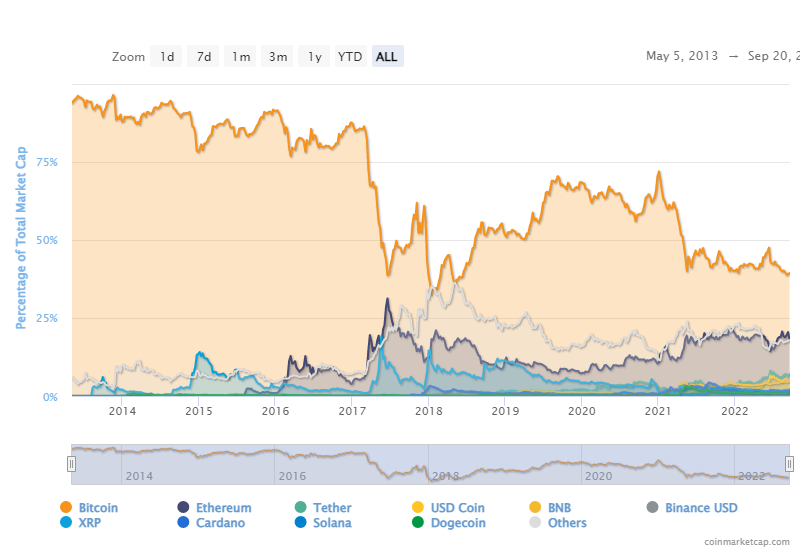

Over the past year, Bitcoin's dominance has ranged between 39% and 47%, being the major influencing coin out of over 20,000 known cryptocurrencies. Of course, as the first and most widely known cryptocurrency, it is well popular; in fact, some people with little knowledge believe that Bitcoin is the only existing cryptocurrency. Hence, whatever is going on with Bitcoin's worth at any given time can influence the market positively or negatively.

Factors That Influence Bitcoin Dominance

Market Direction

In the early stages of the bull market, when the cryptocurrency market starts becoming profitable, Bitcoin dominance becomes higher as people invest more in Bitcoin; however, as the bull run lasts further and new coins enter the market, people begin to invest more in altcoins, in hope for more rapid returns; within that period, altcoins start recording meteoric rises within a short period, and investors are directed towards trading altcoins, which could see Bitcoin's dominance slightly reduce.

Conversely, in the early stages of a bear market, people begin to take profits, putting money in stablecoins to hedge against volatility; however, this reduces Bitcoin's dominance as the market share of stablecoins massively increases. If the bearish run lasts longer, more people may take profits into fiat in the latter stages, which could see Bitcoin's dominance increase again. Hence, it is safe to say that macro and micro trends influence investor psychology, which in turn, influences Bitcoin dominance.

The emergence of New Altcoins

During a bullish run, several new altcoins are introduced into the market, as many investors look for new crypto to make huge profits. Hence, a barrage of these new crypto assets could affect the number of investments going into BTC. However, after the hype behind these new coins, commonly called "shitcoins" (which mostly have no utility and are only riding on the bullish wave), funds are moved out of it, either to BTC and other solid cryptos or entirely out of crypto. At this point, Bitcoin's market share increases, and the dominance index rises again.

How To Use Bitcoin Dominance As A Market Indicator

Basically, the BTC dominance index helps investors to know whether Bitcoin has a stronger hold over the market or the altcoins are ruling. Hence, when the Bitcoin dominance trend is compared side-by-side with Bitcoin's price trend, we can derive a rule-of-thumb formula to get market indicators.

- If the BTC dominance index and Bitcoin's price are in an uptrend, buy bitcoin.

- If the BTC dominance index is in an uptrend, but Bitcoin's price is in a downtrend, sell altcoins.

- If the BTC dominance index is in a downtrend, but Bitcoin's price is in an uptrend, buy altcoins.

- If the BTC dominance index and Bitcoin's price are in a downtrend, sell Bitcoin.

It could also be beneficial to watch out for extreme highs and lows of Bitcoin dominance; for example, if Bitcoin dominance is at historic highs, such as 70%, which was last attained in early 2021, or historic lows like 32%, which was last seen in 2017, investors may need to watch out for reversals.

The crypto market moves in trends, and if a trend has peaked, it may be wise to trade in anticipation of a reversal.

Limitations of The Bitcoin Dominance Index

Using Bitcoin Dominance as an indicator has faced some criticism as to why it is an unsustainable model, which is focused on grey areas that may be difficult to quantitatively observe within an analytical context. They include:

Dead Altcoins

According to research from Fortune, 80% of new altcoins are underwater within a year. Hence, apart from a few good altcoins with successful projects, the rest have either failed or a shitcoins; hence, despite being relatively inactive or even dead, they contribute to the market share of the entire crypto market, which gives a lopsided view of market cap, and by extension, Bitcoin dominance. Hence, some experts argue that the Bitcoin dominance index may be unreliable.

Dormant BTC

According to a Glassnode analysis in 2020, About 10% of Bitcoin's total supply has remained untouched for over 10 years, probably due to lost private keys, dead owners, and several other reasons. Of course, this is more common with Bitcoin; as the first-ever cryptocurrency, many never knew what to expect from this new "financial technology." These untouched Bitcoins may remain dormant for life; hence, experts argue that predicting an active market movement based on the total worth may provide a skewed analysis due to the inactivity of many wallets holding huge amounts of Bitcoin.

Ever Increasing Supply

In the long run, Bitcoin dominance will steadily reduce as more altcoins enter the market; this is apparent from the chart shown above, as the Bitcoin dominance index year-after-year comparison shows that it will keep reducing with the steady increase of altcoin supply.

Although using the Bitcoin dominance index to judge the market relies more on the short-term effect, some experts believe that since Bitcoin dominance will always decrease in the long run, it may be unreliable.

Final Takeaway

BTC dominance tells a lot of details on market trends, and when used correctly, investors can manage their portfolios effectively to gain the maximum possible returns from it. However, the Bitcoin dominance index is just one tool and shouldn't be solely relied upon; it is advisable to consider other metrics before making investment decisions.

For more beginner tips, as well as detailed guides on cryptocurrency and blockchain technology, do well to visit the Cwallet blog (previously CCTIP blog) and follow our social media communities: