How Do Uncollateralized Loans Work In Crypto Lending?

Uncollateralized loans represent a form of borrowing in which the lender extends credit to the borrower without requiring any assets as collateral. This means that if the borrower fails to repay the loan, the lender cannot seize any collateral to recover the outstanding debt.

As decentralized finance (DeFi) grows and becomes more popular within the world of Web3, it becomes increasingly vital to grasp the accompanying developments.

In recent times, numerous DeFi platforms have continually unveiled innovative financial solutions, among which are uncollateralized loans, tailored to meet the evolving demands of their users.

Although crypto lending isn’t limited to DeFi platforms, only DeFi platforms offer uncollateralized loan options, and while they may not yet be as prevalent as other types of crypto loans, comprehending their mechanics is crucial.

A solid understanding of crypto lending, particularly uncollateralized loans, empowers individuals to make informed financial decisions and capitalize on opportunities within the Web3 world.

What are Uncollateralized Loans?

Uncollateralized loans represent a form of borrowing in which the lender extends credit to the borrower without requiring any assets as collateral.

This means that if the borrower fails to repay the loan, the lender cannot seize any collateral to recover the outstanding debt. Instead, the lender relies on the borrower's trustworthiness and ability to repay the loan according to the agreed-upon terms.

How Do Uncollateralized Loans Work?

Uncollateralized loans are based on the principle of approval by consensus. Like many blockchain projects requiring a consensus mechanism for their operations, uncollateralized loans require token holders (or lenders contributing to the liquidity pool) to vote on the creditworthiness of prospective borrowers. Borrowers are usually required to provide data, such as their on-chain and off-chain credit data, to access these loans. Lenders then decide whether to lend you the crypto based on factors like loan amount, loan conditions, on-chain credit data, off-chain credit data, the risk involved, and the borrower's historical behavior.

The purpose of uncollateralized loans is to open the system to new users and non-experts as well as to help the market grow. In that way, it avoids “idle” crypto and allows users to build their crypto-borrowing reputation and creditworthiness by making timely payments on their loans.

While loans without collateral may seem appealing for those who don't want to risk their crypto assets, caution is advised. Some platforms that claim to offer non-collateralized loans might be fraudulent or scams seeking to steal personal information or crypto assets. As such, it's essential to research and choose reputable platforms that have a track record of providing legitimate loans.

Key features and characteristics

1. Creditworthiness: Unlike collateralized loans, which primarily depend on the value of the pledged assets, uncollateralized loans focus on the borrower's credit history, income, employment status, and other financial factors to assess their ability to repay.

2. Higher interest rates: Since uncollateralized loans carry more risk for lenders compared to collateralized loans, they typically come with higher interest rates to compensate for the increased likelihood of default.

3. Fixed or variable terms: Uncollateralized loans may have fixed interest rates and monthly payments, providing borrowers with predictability in their repayment schedule. Alternatively, some loans may have variable interest rates, which can fluctuate over time based on market conditions.

Collateralized Loans vs Uncollateralized Loans

Flash Loans As Uncollateralized Loans

Flash loans are simply loans given to execute a transaction immediately and within the same transaction on the blockchain. This is made possible by smart contracts, which make the whole process automated. Once you apply for a flash loan, you create a series of transactions, also known as arbitrary logic, which include sales, swaps, etc., that you hope will result in a profit. However, whatever these transactions are, the last transaction in that series must be the repayment of the loan. You repay the loan, repay the fee, and take your profit.

Flash loans are beneficial for investors who want to access loans but cannot afford the overcollateralized nature of collateralized loans.

N.B.: Flash loans are only for advanced DeFi users

Crypto Lending on Cwallet

Cwallet is a multifunctional crypto wallet, offering a crypto lending feature that allows users to secure loans against their crypto assets at meager interest rates.

This service combines the functionalities of a wallet with those of a comprehensive exchange platform, making it easy to own and manage crypto assets.

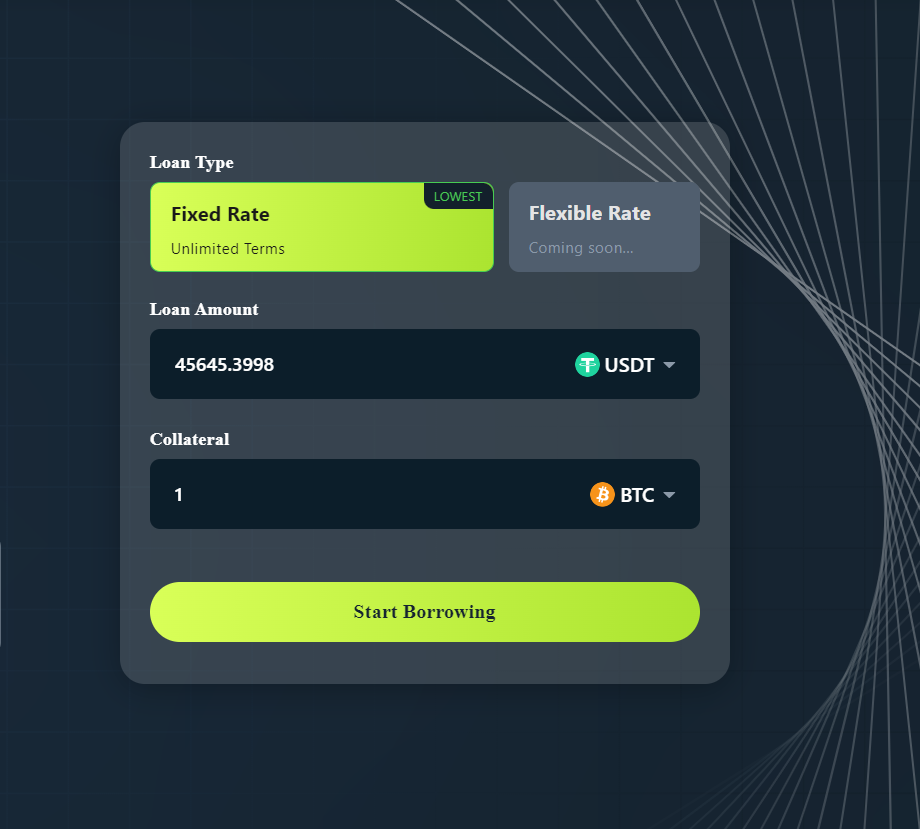

Cwallet's crypto lending feature is designed to be cost-effective and user-friendly, accommodating diverse borrowing needs for both short and extended periods. Cwallet's approach prioritizes simplicity and accessibility, catering to users of all expertise levels.

Cwallet supports fixed-rate lending in multiple cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), and Tether (USDT), allowing you to use 10+ common cryptocurrencies as your collateral while enjoying a whopping 65% LTV ratio.

Final Thoughts

Because they provide a quick way to make a profit without any initial investment, investors usually seek uncollateralized loans. However, while these uncollateralized loans are mostly available to skilled and expert DeFi users, regular users can still benefit from crypto loans via collateralized loans, especially those with a high LTV ratio.

So, whether you are an advanced DeFi user or a beginner looking to take big profits from crypto, there’s a funding option for you to take advantage of the crypto market without liquidating your current assets.

Cwallet offers fixed-rate loans, allowing you to access crypto loans with an indefinite repayment date.

Get started today! Sign up on Cwallet now!